What is earnings quality and how do we measure it?

For a given price, most of us prefer a higher quality product or service over an inferior one. We do this instinctively when shopping for say groceries, always picking the best of the bunch at a certain price point.

This is rational behaviour, and yet this emphasis on quality tends to wane when we switch out groceries for companies trading on a stock exchange. If your dollar can buy 10 cents of earnings (simplistically a price-to-earnings ratio of 10x), wouldn’t you try to get the best earnings you can at this price?

While earnings quality (or “EQ” if you will) has no strict definition, I find it useful to think about EQ in two broad subsets: fundamental EQ and accounting EQ. Fundamental EQ pertains to the future growth, persistence, reliability, and stability of a company’s earnings, while accounting EQ assesses a company’s ability to convert earnings into cash flow.

In fairness, most investors spend a meaningful amount of time thinking about fundamental EQ, which is an essential aspect to successful stock picking. The second subset, being accounting EQ, does not garner nearly as much attention and will be our focus for today.

Accounting EQ is focused on how well a company’s earnings turn into cash flow. Why is this essential? Well, cash (not earnings) is what keeps the company’s lights on, pays the bills, services the debt, funds dividends, and is required to invest in future growth (whether through M&A or organic capital expenditure). Without cash, a company won’t survive for long.

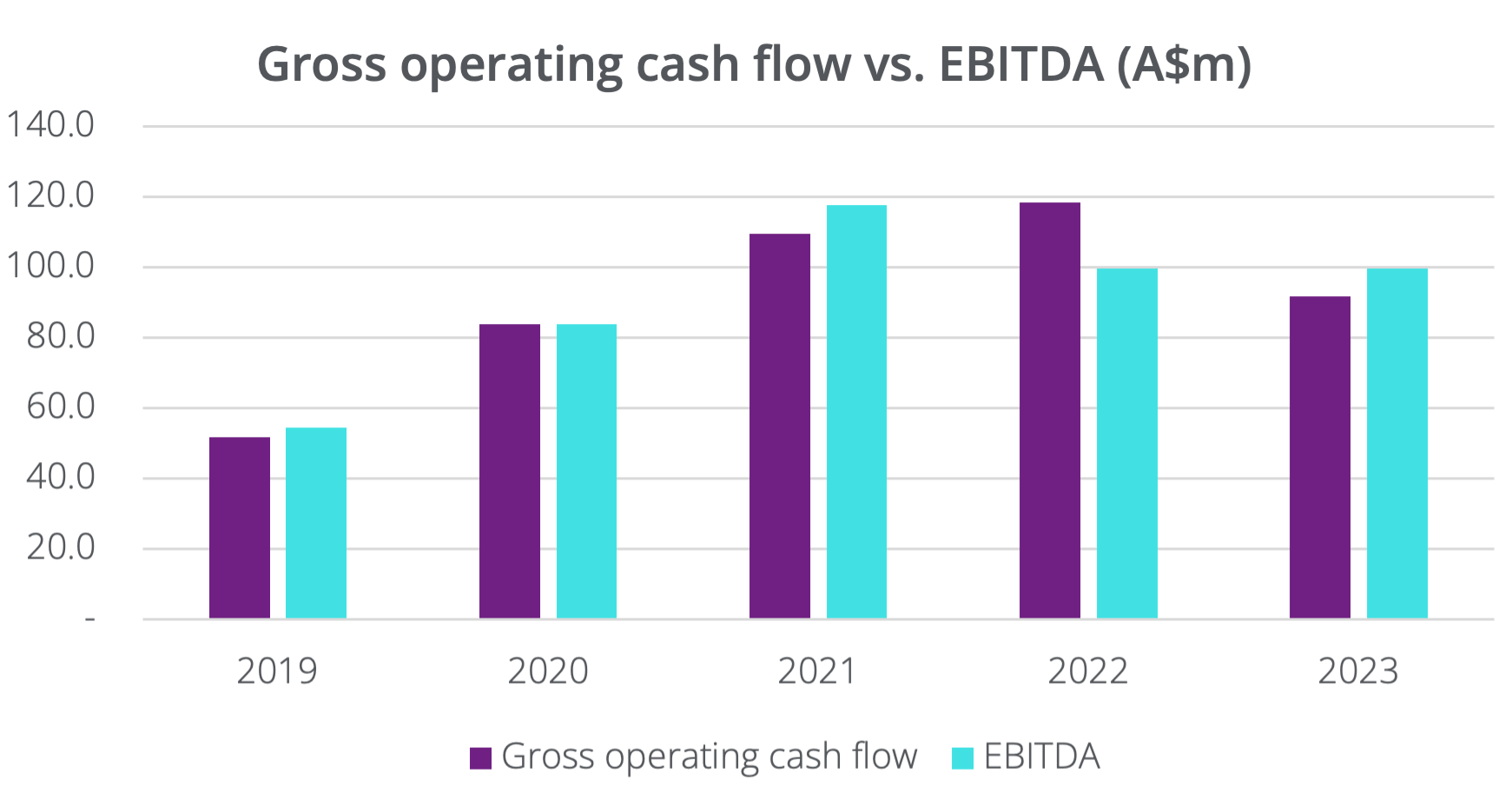

While we might not all be accountants, there are key indicators within a company’s financial statements that can reveal good or bad accounting EQ. For instance, if there is a significant divergence between a company’s net profit after tax in the income statement and its operating cash flow found within the cash flow statement, it’s a signal for further investigation. Similarly, if you notice trade debtors, inventory or other current assets increasing materially ahead of sales, it’s cause for concern. Lastly, tread carefully if a company’s cumulative gross operating cash flow (“GOCF”) over the last few years is meaningfully lower than its cumulative earnings before interest, tax, depreciation, and amortisation (“EBITDA”).

An example of a company exhibiting strong accounting EQ is Hansen Technologies, which is held in our Perennial Value Smaller Companies Trust. Over the past five years, Hansen has averaged a 99.8% GOCF to EBITDA conversion rate. This excellent cash flow collection not only allowed the business to promptly pay down its debt associated with prior acquisitions but also positions it to support future organic and inorganic growth initiatives.

Source: Hansen Technologies Annual Report, August 2023

Another helpful aspect of accounting EQ is that it informs prospective investors if and how a company has been aggressive or conservative with its accounting practices and policies. Accounting standards are based on accruals and not cash flow. Accruals are items that have been earned or spent but for which cash has not yet been received or paid. As such, accrual accounting relies on significant subjectivity from management.

The most common rationale for management to undertake aggressive accounting is to preserve the veneer of positive earnings momentum to maintain an often-elevated stock market valuation. Stock prices are heavily influenced by earnings momentum, and management is often incentivised by metrics such as total shareholder return or some measure of earnings growth. Be wary of any highly valued stock with slowing earnings growth, as this is when the incentive to be aggressive is often at its highest.

In conclusion, when we buy a stake in a company, we are entitled to a proportional share of that company’s future cash flows. Earnings, while important, won’t mean much if they cannot be efficiently converted into cash flow. At the end of the day, it’s helpful to remember that while earnings are often the focus, cash flow is ultimately what you get as an investor.

Marco Correia, Deputy Portfolio Manager, Perennial Value Smaller Companies Trust

Disclaimer: Please note that these are the views of the writer and not necessarily the views of Perennial. Some small changes were made to this article, based on updated information. The contents of this article were prepared for information purposes only. Accordingly, reliance should not be placed on this article as the basis for making an investment, financial or other decision. This information does not take into account your investment objectives, particular needs or financial situation and is not intended to constitute advertising or advice of any kind. The fact that particular securities may have been mentioned should not be interpreted as a recommendation to either buy, sell or hold those securities. Perennial Investment Management Limited is the responsible entity for the fund(s) mentioned in this article. Potential investors should consider the product disclosure statement and target market determination before deciding whether to invest, or continue to invest, in the fund(s). The offer documents and more can be found on Our Trusts page.