Macro Indicators Have Turned a Corner

The second half of 2023 may finally see the IPO window reopen more fully and conditions allowing for acquirers to be more courageous to initiate and close deals. Rate hike moderation suggests inflation has peaked or is close to peaking which is injecting more confidence into equity markets.

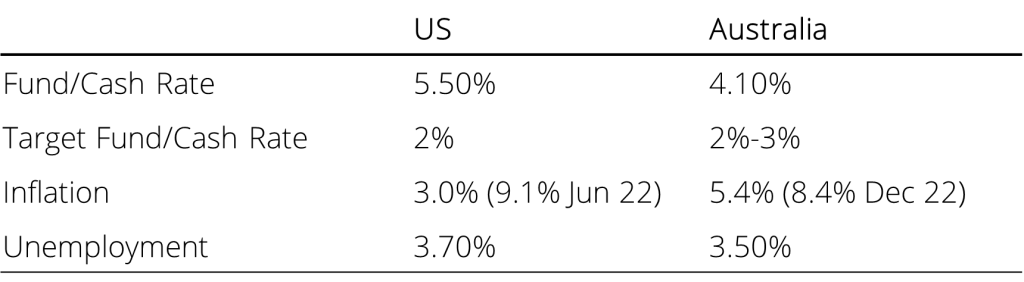

In the US, fears of a ‘hard landing’ has not materialised and much of the narrative has shifted to a ‘soft landing’ with a shallow recession. Furthermore, the Federal Reserve increased the funds rate by another 25bps to 5.5% in July (the highest in 22 years) after pausing in June, while continuing to assess employment and stability in prices. Continued economic activity has meant the unemployment rate remained tight at 3.7% while inflation had cooled to 3.0%, off the peak of 9.1% reached in June 2022. While attentive to inflation risks, the market was buoyed by disinflation which has not been detrimental to the job market.

Domestically, the RBA has had 12 rate hikes to 4.1% while targeting a medium-term inflation rate of 2%-3%. With inflation reaching 8.4% in December 2022, the RBA’s hawkish monetary policy has had a dampening effect on inflation, which has consistently slowed over the course of 2023. Inflation dropped to 5.6% in May and continued a further drop to 5.4% in June. On a quarterly basis, March inflation was 7.0% while the June quarter fell further than consensus expectations to 6.0%. Job market data for June still remains very tight at 3.5%, indicating economic activity remains robust but softer than expected retail data (trade dropped 0.8% in June) demonstrates the RBA’s actions are having an impact and nearing its end.

High Level Key Indicators

Source: Federal Reserve, RBA, ABS data

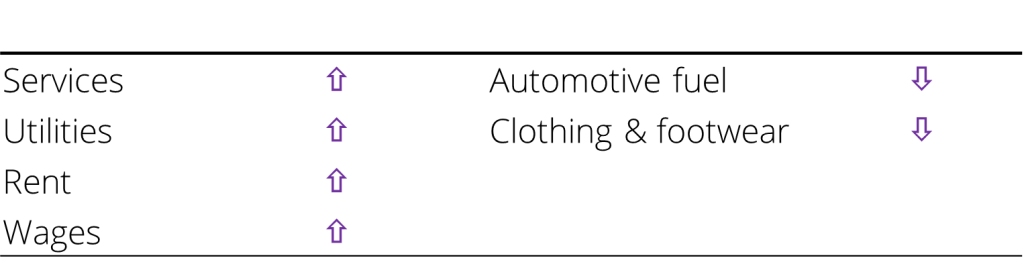

Selected Australian Inflation Contributors

Source: ABS data

While macro uncertainties still remain including geopolitics, likely continued ECB rate hiking, slower Chinese economy, impact of Australian households moving off fixed to variable rate mortgages, the main handbrake on investor activity has been inflation, unending rate hikes and recession fears. The aforementioned US and Australian interest rate and inflation data and central bank commentary encourages some cautious optimism in both public and private markets. In the next month, the RBA’s August 1 meeting on monetary policy as well as the earnings season results will be key to watch.

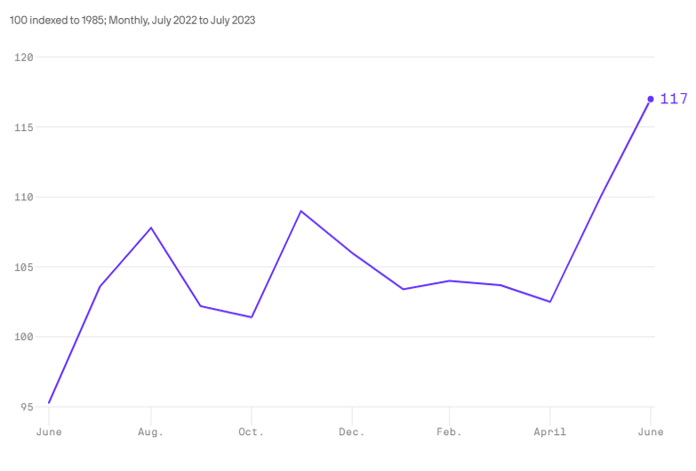

Consumer confidence is also on an uptick in the US as per The Conference Board’s recent data released in July, especially in the last 2 months.

Consumer Confidence Index

Source: The Conference Board; Axios

The IPO Pipeline is Building

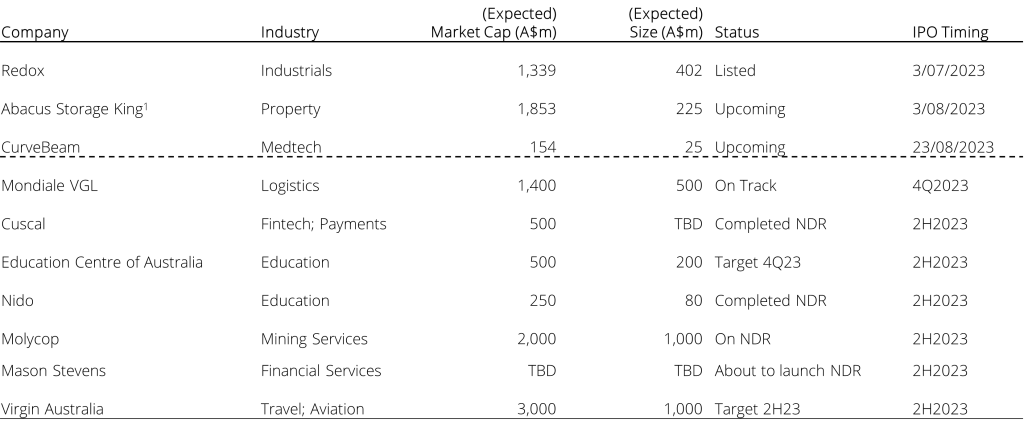

The ASX, which has seen a dearth of listings for most of the last 18 months, has finally got a double digit roster of highly prospective candidates (see table below). The most recent listing was Redox which raised north of $400m to achieve a $1.3B valuation market capitalisation. It is currently trading around 90% of its IPO price and encouragingly has not seen the dramatic value declines from 2021 listings. The Redox IPO performance to date demonstrates that the deal was priced close to fair value and appropriate pricing and a shareholder register composition to ensure aftermarket support. This has certainly encouraged the class of 2023 IPOs to embark on non-deal roadshows to warm up investors and provide investor education.

Selected Potential 2H2023 ASX IPOs

Source: Company prospectuses and news reports.

Note: 1 Demerger from Abacus Property Group (ASX: ABP)

A few common themes emerge from the above IPO hopefuls, including:

- Leaders of the Pack: Many of the companies pursuing a listing are leaders in their space or hold a top 3 position.

- Size does Matter: IPOs with at least $100m in market cap will get more of a look in by fund managers who value larger caps which generally have more liquid.

- Steady Sustainable Growth with a Track Record of Profitability: The current crop of prospective IPOs have established businesses with a track record of solid growth and profitability so they can be priced on an EBITDA or earnings versus a revenue multiple.

- Traditional Sectors: More traditional sectors with good tailwinds are first to test the market. It is expected that growth sectors such as technology could follow the lead given the scarcity of quality tech growth stocks with more recent takeovers.

- Pricing: The pricing of the IPO deal will be important and it is expected the traditional ‘IPO discount’ will need to be favourable to garner institutional support given the other listed alternatives available.

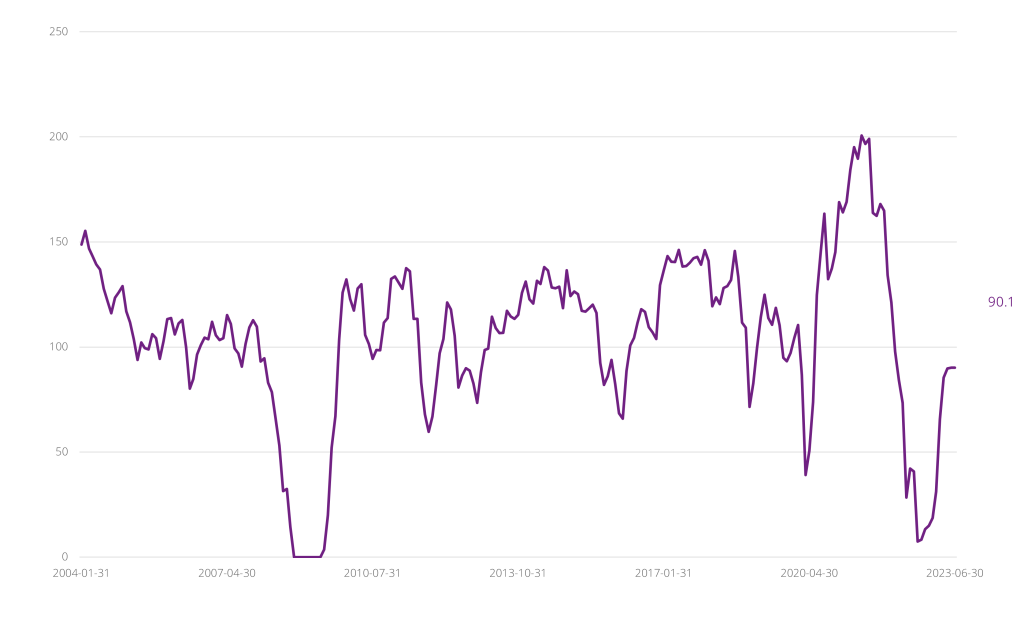

It is also worth noting a study by Goldman Sachs in September 2022 and March 2023 conducted on 4,500 US IPOs over 4 cycles in the last 25 years. The best performing IPOs since 2010 were those that had at least 40% year-on-year growth in years 1 to 3 post listing and were profitable by at least year 2. A key reason for underperformance from the class of 2020-2022 IPOs was that they were less profitable than previous cohorts and had a faster rate of sales growth deceleration. Goldman Sach’s proprietary IPO Barometer is currently sitting at 90+ which is the highest levels since March 2022, where 100 is the level for normalized conditions for IPOs, indicating much better macro condition for IPOs has recently materialised. The barometer is based on a few key indicators including: S&P500 drawdown, CEO confidence, ISM manufacturing index, interest rates and S&P trailing EV/Sales.

Goldman’s IPO Barometer Reaches 90

Source: Goldman Sachs Research, 30 June 2023

Private Markets are Lagging but Activity Beginning to Pick up

In Australia, 2Q2023 data from Cut Through Venture indicated a shifting focus to earlier stages with most activity occurring at the pre-seed stage. Further, there was an overall decline in deal count and size for the quarter. The second quarter of this year saw $810m raised over 90 deals or $1.5bn for the first half of the year which brings activity back to pre-COVID levels. Much of the action has also been in the form of internal rounds which is not captured in the reported data.

Many private funds which raised in the heady days of 2021 have been sitting on the sidelines but are also subject to ‘investment periods’, so it is expected that more deal activity will pick up. A common theme for funds still investing is longer due diligence processes to build conviction. Funds with the nerve to invest will find there are great opportunities on much better terms than in 2021, providing a strong margin of safety.

Greenshoots to have an Ecosystem Effect

The ecosystem effect of the greenshoots we are currently seeing should help drive new economic activity and growth. Companies being able to exit via the listed markets filters down through to the private late stage and all the way down through to the early stages. With more overall positive sentiment, later stage companies will more likely progress to pre-IPO and then IPO. The difference is that in this market, it will be the higher quality companies that dare make a play for a listing. As a more conducive IPO market ‘unblocks’ a key exit pathway, this encourages confidence in investors to put more capital to work knowing an exit is a real possibility, which drives more liquidity back in the hands of their ultimate investors and limited partners, thus driving more allocations into new funds and investments. More certainty in interest rates would also drive potential buyers to pursue debt financing which would further drive M&A and investment activity fuelling more activity across the ecosystem.

Disclaimer: Please note that these are the views of the writer and not necessarily the views of Perennial. This article does not take into account your investment objectives, particular needs or financial situation. Some small changes were made to this article, based on updated information.