While there is fierce debate over when the world will reach peak fossil fuel demand, there is no denying that the pace of the energy transition and the decarbonisation of emission-heavy industrial processes needs to improve if we are to come close to achieving net-zero by 2050. The problem is that this requires metals production to nearly double right at a time when new projects struggle to come online due to a lack of investment and growing red tape.

This brings us to the posterchild for this growing demand, copper, or as it is commonly called “Dr Copper” due to its ubiquity across the world economy. Copper is ductile, antimicrobial, corrosion-resistant, and possesses excellent thermal and electrical conductivity. This means that regardless of how the world’s industrial processes and electricity generation mix change over the next few decades, copper will be at the heart of it and crucial to lowering emissions.

Pleasingly, government action has been swift with incentives across the board. Between the US Inflation Reduction Act (IRA) and the EU’s Net-Zero Industry Act (NZIA) alone, over US$1tn has been committed to green technology and the energy transition, with copper added to the critical minerals list.

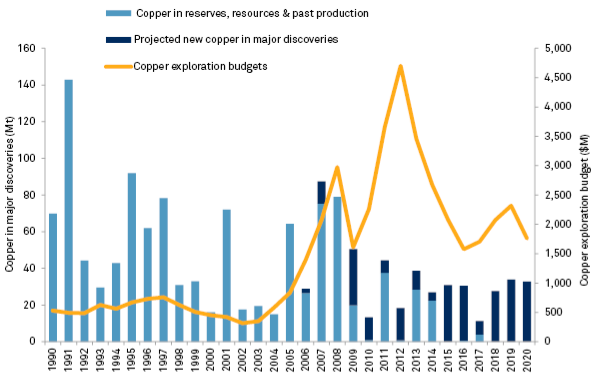

On the surface this is great news for copper, with demand subsequently forecast to double by 2035. However, supply growth has stalled due to a combination of underinvestment, increased regulation, and most importantly, a lack of large-scale economic deposits in stable jurisdictions. While secondary supply (recycling) contributes around 15-20% of current global production and has scope to increase, primary (mining) supply growth is sorely needed.

Even though large mines like Cobre Panama, Kamoa-Kakula and Oyu Tolgoi have begun production in recent years, it has been a rocky road characterised by multiple delays, capex overruns, and fractious negotiations with governments. In the meantime, mine grades have continued to decline, and large-scale production (250ktpa+) remains dominated by mines that started production before 2000.

Source: S&P Global Intelligence, as of 22 April 2021

Source: S&P Global Intelligence, as of 22 April 2021

To meet net zero targets, production needs to grow by ~1mtpa by 2050, but this looks increasingly unlikely considering that the sector only averaged ~430ktpa from 2008-2020. Compounding this, the average time to develop a greenfield project has blown out to over a decade, with brownfield projects not much better at around seven years. This slowdown in new supply is happening right as mine supply is forecast to peak in 2024 once the last of the new major projects (Kamoa-Kakula, Oyu Tolgoi and QB2) have ramped up to full production. Beyond this, there is not a surplus of promising projects in the pipeline, and the regional powerhouses of Chile and Peru are struggling, with production falling to seven-year lows. Industry experts are now forecasting a supply gap of 6-10mt by 2035 unless something changes. Granted, as prices increase in reaction to any deficit, we will see more projects come online but it will not be a quick fix.

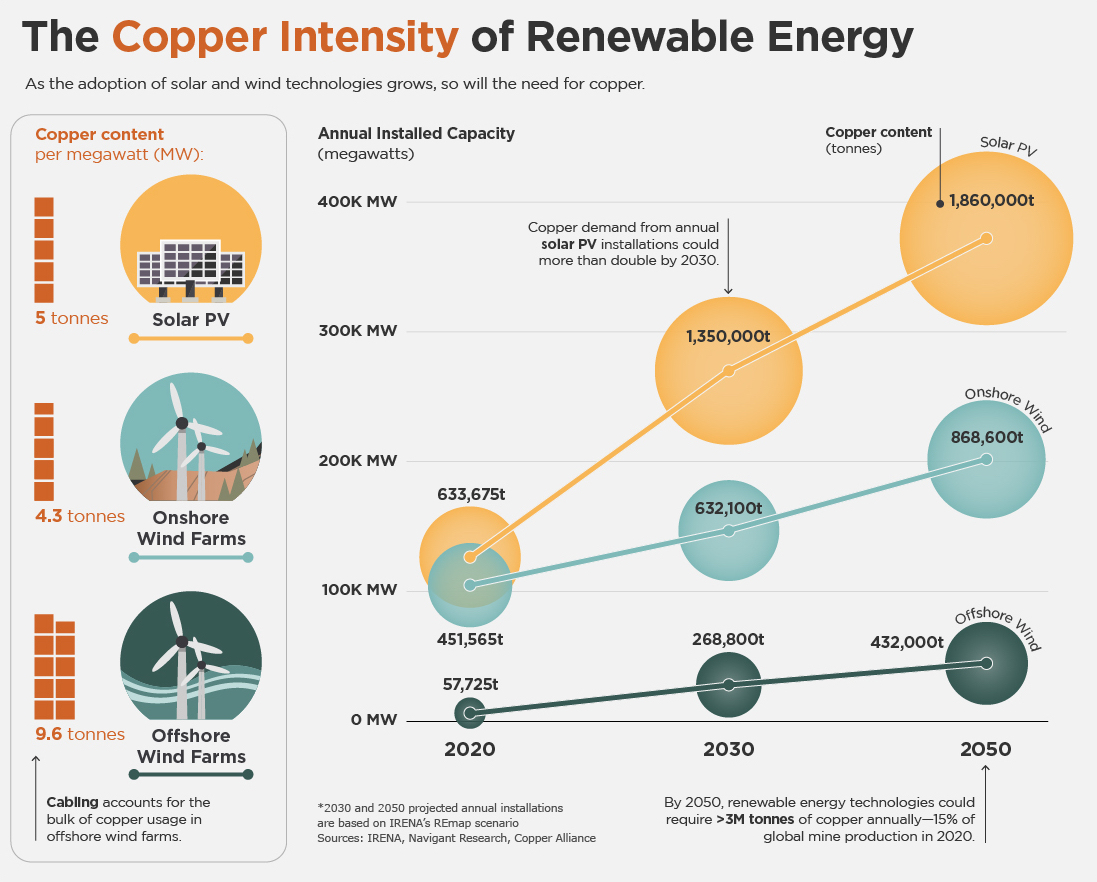

Underlying all of this is the copper intensity of the energy transition. An electric vehicle (EV) uses around 2.5 times more copper than a traditional car, with offshore wind and solar needing 5 times and 2 times more copper, respectively, than their fossil fuel equivalents. The reason this matters for copper demand is because the penetration of EV’s and renewables into the transport and energy sectors has been swift, government-mandated, and will only increase exponentially moving forward.

Source: Bloomberg NEF

Source: Bloomberg NEF

This is just the tip of the “green” iceberg, and copper will be an intrinsic part of successfully decarbonising the energy and industrial sectors. Current forecasts estimate that ~50% of additional copper demand by 2035 will be directly tied to the green transition. As S&P noted in 2022, “If we are to meet energy transition targets, the amount of copper that’s going to be used over the next 28 years is going to exceed all of the cumulative copper consumption that the world has seen since 1900”. Taking all the above into consideration, how does this drive our investment process for copper in the Strategic Natural Resources Trust? Our primary focus is on companies with assets already in production that are poised for growth through low-risk brownfield assets in their pipeline. An excellent example of this is Capstone Copper. Capstone Copper is a Canadian listed copper producer with an attractive suite of producing assets in the US, Chile and Mexico, along with a pathway to nearly double their 2022 production via low-capital brownfield expansions.

The role of copper in successfully reaching net-zero cannot be overstated enough. It is the glue that binds together a myriad of technologies and sectors as we look to reduce our emissions profile. While mining always needs to be undertaken in a responsible manner, it is imperative that public and private entities start working together in a more cohesive manner to ensure that copper supply does not stall.

Ewan Galloway, Deputy Portfolio Manager, Perennial Strategic Natural Resources Trust

Disclaimer: Please note that these are the views of the writer and not necessarily the views of Perennial. Some small changes were made to this article, based on updated information. The contents of this article were prepared for information purposes only. Accordingly, reliance should not be placed on this article as the basis for making an investment, financial or other decision. This information does not take into account your investment objectives, particular needs or financial situation and is not intended to constitute advertising or advice of any kind. The fact that particular securities may have been mentioned should not be interpreted as a recommendation to either buy, sell or hold those securities. Perennial Investment Management Limited is the responsible entity for the fund(s) mentioned in this article. Potential investors should consider the product disclosure statement and target market determination before deciding whether to invest, or continue to invest, in the fund(s). The offer documents and more can be found on Our Trusts page.