Most people who work in equities are optimists by nature. Sure, we approach everything we are told with a healthy degree of professional skepticism but, fundamentally, we believe that the future will be bigger and better than the past. The equities market is, after all, forward looking and if you didn’t believe this, you’d never invest in the stock market (and probably have a whole portfolio of government bonds). Fortunately for us all (not just investors), history has shown that this is usually the case – economies expand, technology advances, living standards improve, corporate profits grow and share prices go up.

However, nothing occurs in a straight line and 2020 proved to be quite challenging on many fronts. Not only did the world have to deal with the impacts of COVID, but the global political backdrop deteriorated sharply due to a number of factors, most significantly being the actions of the US leadership.

Roll forward to today, however, and things are looking much brighter. Effective vaccines are being rolled out rapidly, the US is now led by an experienced politician committed to restoring the US to its global leadership role and people the world over are seeing light at the end of the tunnel in terms of life returning to normal.

Importantly, while the pandemic has seen yet more cuts to interest rates and further rounds of quantitative easing, the focus has now moved to fiscal measures. Not only will these new measures provide the opportunity for reform and change, but they are likely to have a more positive and long-lasting economic impact than the previous prescription of: cut interest rates, increase debt, push up asset prices etc, which, amongst other things, has led to great social inequality.

What does this mean for investors? The market is clearly now looking forward with optimism to a more recognisable “Post-Trump, post-COVID” world. In this environment, normal activities resume, global economic growth rebounds and we get back to something resembling business as usual. Combine this with historically low interest rates and fiscal stimulus and the backdrop is pretty positive.

However, there will be important implications for the performance of different sectors of the market. Over recent years, weak economic growth, persistently low inflation and declining interest rates have seen growth stocks outperform strongly. The best example of this is in the US, where the rise in the S&P500 has been almost entirely attributable to the performance of a limited number of large Tech stocks, while many other sectors have languished.

In the scenario above, the factors which drove the outperformance of growth stocks will reverse, with economic growth rebounding strongly, inflation rising and interest rates no longer falling. History has shown that this usually triggers a rotation out of growth stocks and into value stocks. In fact, in the Australian market, the end of every US recession in the last 40 years has been followed by a period of outperformance by value stocks.

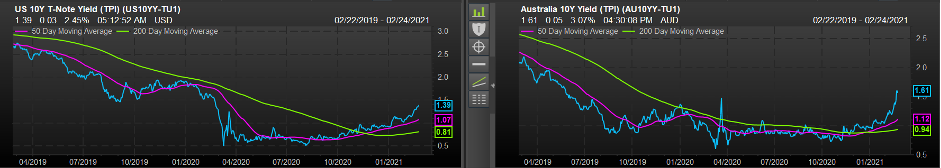

We are already beginning to see this rotation occur. Global growth forecasts are being lifted, inflation expectations are increasing and bond yields, both here and in the US are beginning to rise, challenging the assertions of central banks that rates will stay at very low levels indefinitely. The charts below show the recent sharp rise in the US and Australian 10-year Government bond rates.

In the equities market, the rotation from growth to value is clearly underway, with cyclical sectors such as Resources, Energy and Financials outperforming rate-sensitive sectors such as Healthcare and Infrastructure. In the US market, the share prices of the large Tech stocks are coming under pressure as investors question their extreme valuations in the face of both rising costs of funding and increasing regulatory scrutiny.

Should conditions continue to normalise as we expect, then this rotation from growth to value may still have a long way to go, given the extreme valuation dispersion which has developed between different sectors of the market. In fact, the current level of valuation dispersion is even greater than at the height of the first tech boom back in the last 1990’s.

What are some of the broader implications of the last year? The pandemic has highlighted how critical it is for the global community to work effectively together. The COVID crisis has brought into sharp relief the fragility of many international systems and the work that will be needed to make them more robust. Fortunately, it is likely that the US will take steps to resume its leadership role on global issues from COVID to climate change to international relations – in particular the relationship with China, which is of critical importance to Australia. Further, the disruption from living in lockdown, working from home and similar has led to an acceleration of digitisation, an increased level of flexibility and new ways of doing things. This will speed up innovation, leading to better and more efficient ways of doing things going forward. The rapid uptake of telehealth is the perfect example. While the benefits this could bring in terms of accessibility, cost and efficiency have been long known, it took the pandemic to really drive its implementation.

Lastly, the pandemic has brought an even sharper focus on the environment (with disease outbreaks being, in effect, an environmental risk). The post-pandemic stimulus measures in various countries are likely to include infrastructure investments which will drive a further acceleration in the energy transition away from fossil fuels. All of these factors are positive developments.

While there is always plenty to worry about, it is worth remembering that, on the long view, the world has always gotten better and there’s plenty to be optimistic about right now.

Disclaimer: Please note that these are the views of the writer and not necessarily the views of Perennial. This article does not take into account your investment objectives, particular needs or financial situation.