With so much focus on the rapid rise of passive investment strategies, it’s important to remember the role active management can play in a portfolio. Not only can active managers add alpha, they often perform best in more challenging markets when investors appreciate it most. Further, certain asset classes are clearly more suited to active versus passive management.

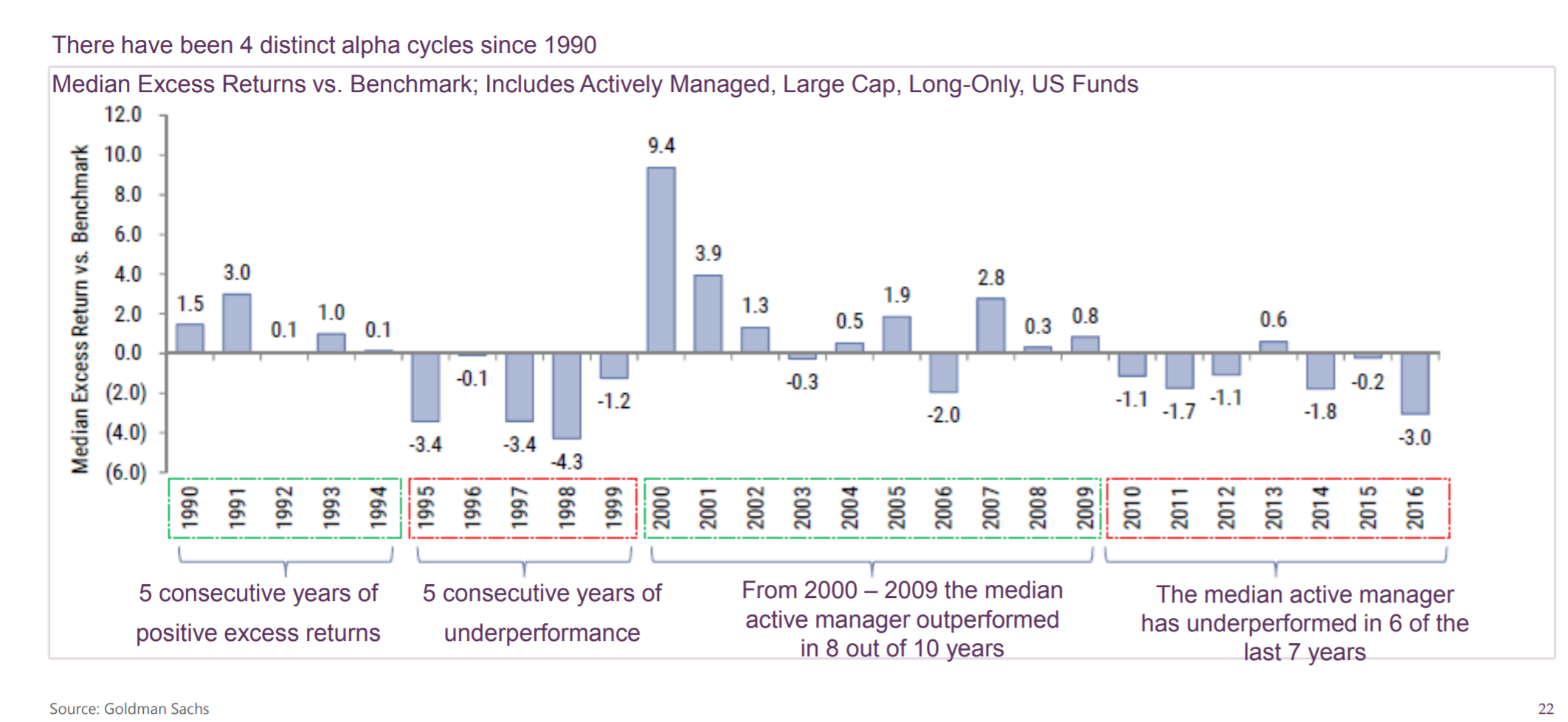

While recent times have been difficult active managers as a group, history suggests that the amount of alpha generated by active managers tends to move in cycles. The chart below shows the active alpha cycles in the US market and demonstrates 4 clear periods of outperformance and underperformance:

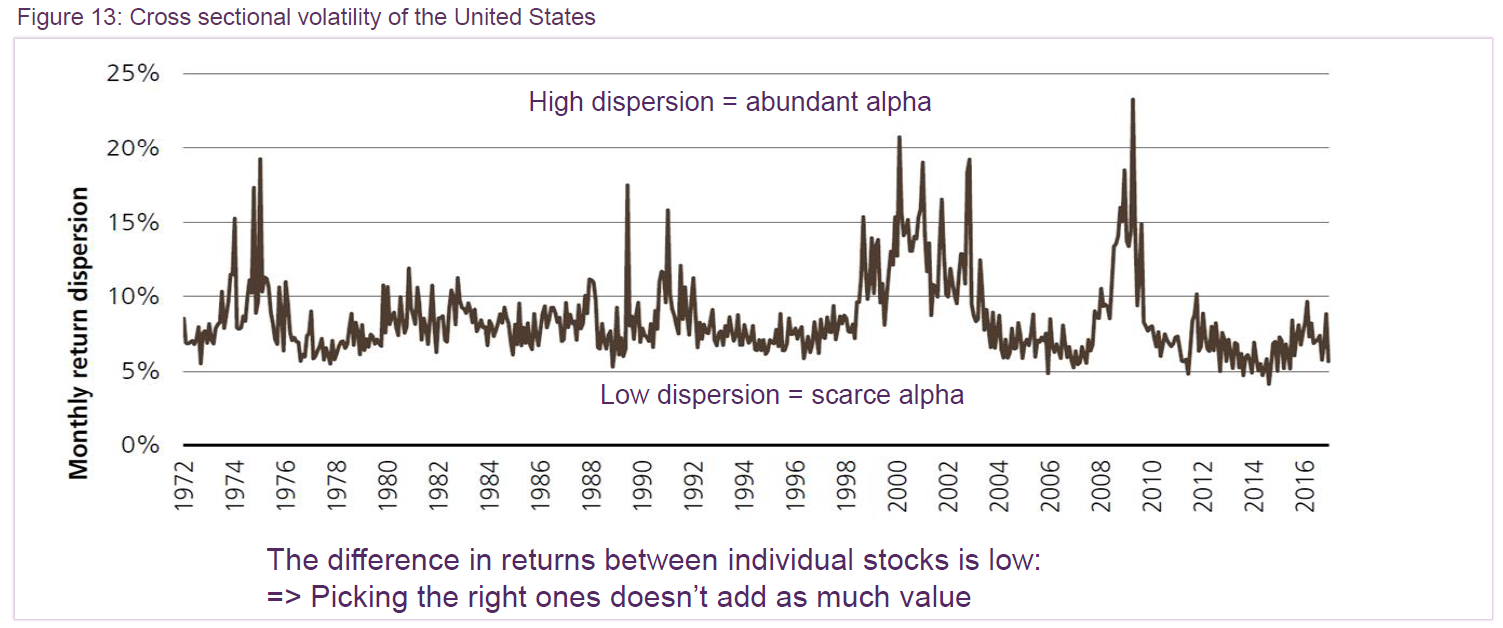

So what is driving these cycles? Firstly, it is likely that these cycles are being driven by changing market conditions, namely the levels of dispersion amongst stock returns. Put simply, when dispersion is high the differences in individual stock performance is greater, meaning the reward to picking the “right” stocks is greater. By contrast, when dispersion is low, even if you pick the outperforming stocks, the reward is smaller. The chart below shows how, in the post-GFC period, the overall levels of dispersion in markets have generally been below historical levels:

Source: Factset,UBS Quant, Universe: Russell 1000

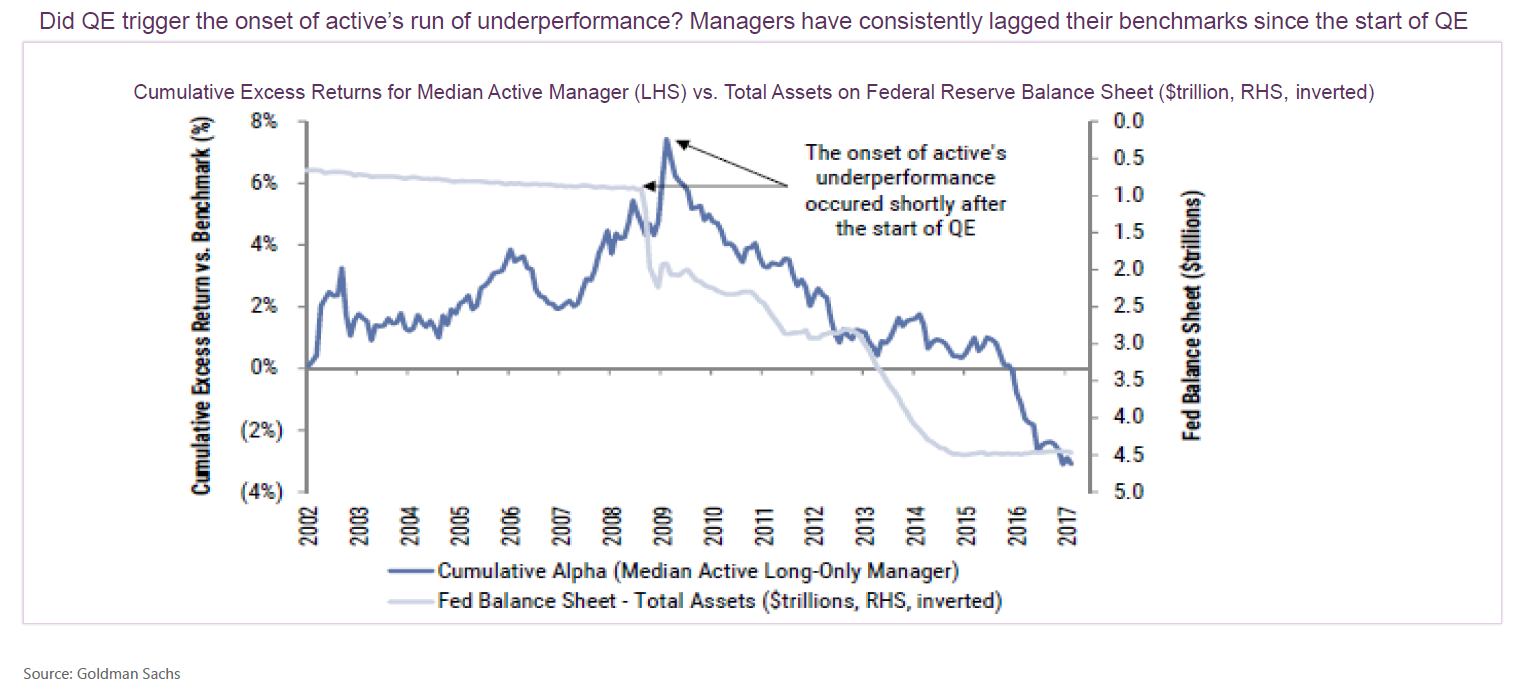

This low level of dispersion is likely the result of quantitative easing and other interest rate policies which have been designed to supress volatility and support markets. As a result, the opportunity for active managers to add alpha has been lower than in the past. The chart below shows a pretty compelling link between the underperformance of active managers and the onset of QE:

Secondly, active managers by and large have investment processes based on valuation disciplines. As a result, they tend to lag in market environments where valuation seems to be less of a focus. This is often when either markets become overly euphoric, such as in the late stages of a bull market, or alternatively, in momentum-driven markets such as we are seeing currently, where many investors appear willing to pay almost any price for stocks with strong earnings prospects.

However, when conditions inevitably change and the tide goes out, active managers are likely to show their worth. Just as ultra-loose monetary policy has supressed volatility and reduced alpha-generating opportunities in recent years, the increases in cash rates and the move from QE to QT (quantitative tightening) we are beginning to see are likely to lead to higher levels of volatility and therefore greater alpha opportunities for active managers in the years ahead.

Similarly, when highly-priced “market darling” stocks inevitably stumble, investors will question and reassess the prices they are willing to pay for these – often in a brutal way. Here, active managers who have taken a prudent approach to the price they are prepared to pay for stocks are likely to be well rewarded. We have seen this in the past, with active managers performing well during periods of market disruption around the Tech Wreck and in the immediate aftermath of the GFC. It is in these difficult market periods where investors most appreciate some extra return that active management can deliver.

Therefore, the danger of building a portfolio with purely passive products is that investors could potentially miss out on significant alpha in down markets. This could leave investors exposed to greater sequencing risk due to the pure market exposure of many passive investing vehicles, which means investors experience the full force of any major market declines.

Finally, certain asset classes are clearly well-suited to active management. Good examples are small and micro-cap equities where markets are more inefficient allowing good managers obtain an informational advantage and uncover many undervalued stocks. This has enabled them to outperform the index by a considerable margin. Similarly, income-focussed portfolios can benefit from active management. Passive strategies which just focus on selecting stocks with high dividend yields often end up investing in “dividend traps”, that is stocks which appear to offer an attractive level of dividend yield but where the outlook is negative, leading to earnings downgrades and share price falls. Much of this can be avoided by an active process based on fundamental analysis. Finally, fixed income is also well-suited to active management, where the manager can actively make the duration decision to benefit from the changing interest rate environment.

So while passive strategies have been taking the limelight in recent years, it is important to remember that longer-term market cycles have favoured both active and passive at different points and as we head into a higher-growth, rising interest rate and more volatile environment, it could be time for active managers to outperform.

Stephen Bruce is Director of Portfolio Management at Perennial Value Management