A spate of takeover activity recently has raised questions on whether the ASX is on an ongoing contracting trend and losing its relevance for private companies as a liquidity option. Many of these targets in recent months have not just been large caps but activity has also been rampant in smaller caps, such as A2B Australia Limited, Ansarada, InvoCare, McGrath Estate Agents, Prospa and Whispir. Key drivers of this activity include: attractive valuations, increased confidence around deal making with the interest rate path no longer on an only upward trajectory and a lower than average historical Australian dollar have made targets particularly attractive to foreign bidders. At the smaller end of town, some valuations have been oversold, consistent with historical trends of larger sell offs in bear markets with this trend reversing in bull markets.

ASX is Still Highly Active and Liquid

That said, the ASX is a highly liquid exchange with $8 billion traded daily based on the 12-month rolling average to December 2023. Australia is also home to the 5th largest pension market globally per research by Thinking Ahead Institute. Total funds under management stands at $3.7 trillion at the end of December 2023 and this is expected to grow to $11.2 trillion by 2043 according to a recent report by Deloitte. The Australian super funds are also ranked first globally for allocation to listed equities and its allocation to the ASX comprises circa 36% of the total market capitalisation. This drives liquidity given the constant and growing annual flows which reached $173 billion for December 2023 according to APRA, especially with the super guarantee, or employer compulsory contribution, growing from 9.5% for FY2021 to 12% from 1 July 2025.

The ASX is also one of the most active exchanges globally by listings, listing 45 companies in 2023. This compares to 131 on JPX, 100 on NASDAQ, 70 on HKEX, 34 on LSE and 26 on NYSE. As expected, with Australia being a smaller market, the activity is not too far off by global standards and the dearth of capital market activity is apparent across global exchanges.

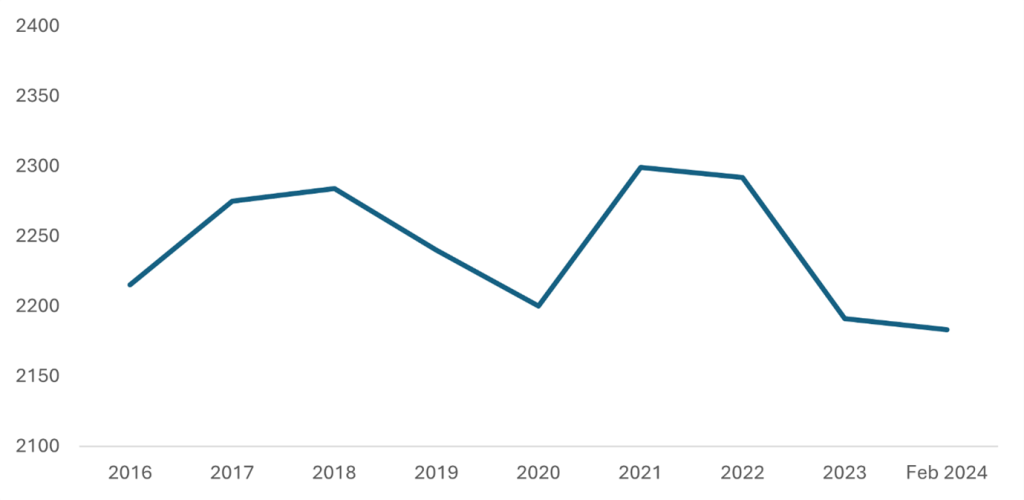

The number of companies and securities listed on the ASX is indeed below where it was 10 years ago to 2,183 at the end of February 2024. Takeovers accounted for the most delisting activity with ASX-listed companies accounting for 23% of value retained on the exchange from 2017-2023.

Number of Companies and Securities on the ASX

Source: ASX

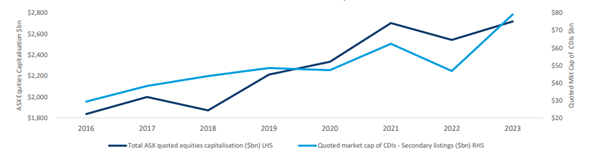

On the flipside, the growth in the quoted market capitalisation has been on an increasing trend over the same period.

Expansion of ASX Quoted Market Capitalisation

Source: ASX

Commenting on these trends, James Posnett, General Manager, Listings at the ASX, notes:

“ASX continues to grow, measured by total market capitalisation and by net capital quoted on the market, taking into account the value of new listings, secondary capital raisings and delistings.

The IPO market is cyclical, after an extremely busy 2021 it has been relatively quiet over the past couple of years, similar to 2011-12, but activity will inevitably return and we are expecting a broader reopening towards the end of this year and into 2025.

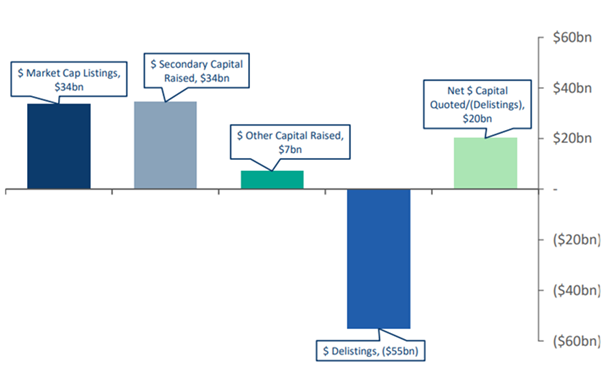

Despite $55 billion in quoted delistings, overall net quoted capital in 2023 was $20 billion in the positive from IPOs and capital raised, not to also mention the recent share market accretion as many companies have seen their market capitalisations expand.”

2023 New Capital Quoted & Delistings by Category

Source: ASX

Historically, many companies listed well before they were ready and became prime M&A targets. Some also chose the de-listing path voluntarily given low liquidity levels where a stock has underperformed, subscale and lost relevance to investors. In addition, the public markets are inherently efficient and poor performing stocks are either acquired or delisted by strategics or even opportunistic acquirers who are able to work with the companies privately before relisting them again. Being listed also gives companies more exposure which can attract more bidder attention. It should also be noted it is difficult to execute on hostile takeovers where boards are not supportive. With more private capital, companies are now able to stay private for longer and avoid being listed while they are not ready or too small. Furthermore, many acquisitions should really be viewed in a positive light in that they provided a genuine strategic fit and delivered shareholder returns (both at the time of acquisition) and post acquisition, so they really should not be viewed as simply ‘take privates’ without the appropriate context.

The IPO Window Opens and Closes

Historically, the ‘coming of age’ of companies would be heralded via the landmark occasion of a public listing. Why? This is the ‘liquidity event’ for founders, management teams, employees and investors. Founders and management would still be able to operate and scale as a standalone company versus operating as a division of a strategic acquirer or a portfolio company of a private equity owner. Additionally, there is the elevated brand awareness and increased credibility amongst customer and suppliers.

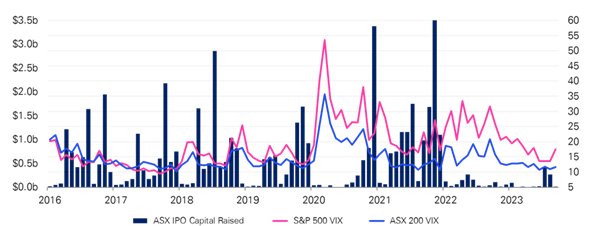

Capital markets activity is inherently cyclical and has pockets of both high and low activity. Recent rate rises and market volatility have contributed to a lack of listings with the market more recently adjusting to a higher rate environment but one where imminent and constant rate rises are no longer present. The market has now reached a cyclical lowpoint with no material sustained activity since 2021 and a rebound is on the cards. Companies that have been biding their time and waiting for the right moment to go public, may find the upcoming years particularly conducive to making their move.

ASX Historical IPO Activity and VIX / ASX200 Market Volatility

Source: ASX

Over in the US, two winning IPOs in the space of a week in March provide signs the gates are about to more fully open for IPO liquidity. Social media platform Reddit and AI infrastructure hardware provider Astera Labs experienced 48% and 72% pops on their first day of trade. Both are also benefiting as “AI” stories. According to Bloomberg, there have been 44 IPOs on US exchanges versus 36 (+22%) this year versus last year and companies this year raised US$9.1bn versus US$3.5bn (+160%) the year prior. This bodes well for more companies to test the waters before the US summer. Off the back of the recent success, Ibotta, a Walmart-backed digital marketing software firm has filed for an IPO as has cloud cybersecurity platform, Rubrik . Local hopeful, Tasmea was also able to accelerate its bookbuild and is aiming to be listed by end of April.

Can Companies Be Private Forever?

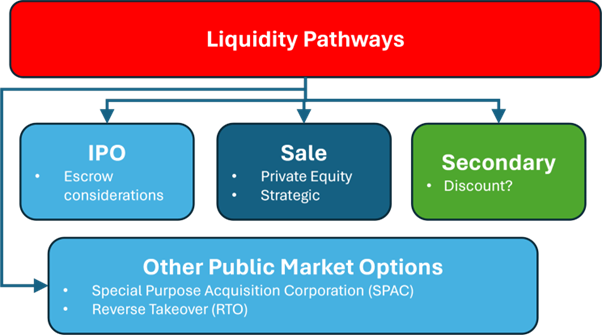

Ruling out IPOs, this removes the number one most obvious liquidity pathway for many companies. Outside of Australia, this pathway is the exit pathway for many global venture and also for many private equity and crossover firms. Other options are available such as a trade sale, secondary sale, or other public market liquidity routes such as SPACs and RTOs. Ventures capitalists are hunting for generational companies and these companies can continue to exist in perpetuity versus being swallowed up by their competitor in the alternate pathway of a sale.

Source: Market Musings

Detractors of the public markets would argue that there is a lot of dry powder in the private markets which could theoretically keep a company out of the public domain forever. While it is true that this can help support companies to gain scale out of the public eye, private and secondary markets have certainly achieved more depth but have not fully developed to provide true liquidity across all private companies. The depth of the private markets is still to be built out and while there is a growing secondary market, the majority of demand and activity lies in “unicorns” and in some cases “soonicorns.” Demand for secondaries in other earlier stage high quality names is also very company specific and best absorbed by existing investors who want to build up their position or incoming investors into a new round. In addition, while more patient capital exists to support companies to stay private for longer, actual cash returns will be required for many investors.

While staying private for longer is great for achieving scale, some companies also get too big to be sold, such as in the case of Figma where Adobe abandoned its planned USW$20 billion acquisition due to regulatory considerations in the UK and the EU where the Competition and Markets Authority and European Commission said the deal could significantly reduce competition.

What is the Opportunity?

Recent corporate activity points to a significant opportunity for IPO hopefuls.

Firstly, listed fund managers have a captive universe but are accordingly hunting for and receptive to new ideas that are compelling. However, they need to sell out of their existing positions so valuation and growth prospects will need to stack up to make the trade work. With IPOs on the cyclical upswing and fewer names in their universe, new listings will be looked at closely.

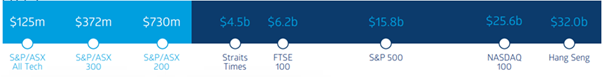

Secondly, quality names are likely to be well received and an exchange like ASX also provides for earlier index inclusion compared to other global exchanges where the market caps thresholds are much higher.

Source: ASX

Thirdly, the lack of lack of direct and/or reduced comparables is both a positive and a negative as this would require more education for investors. Investors also face the conundrum of how best to value a company without obvious comparables but this is a problem that has been solved many times before, especially for companies that are leading the way in a new category. Category leadership or category access is possible locally.

Fourthly, the later stage is still largely “blocked” and this is because of the limited number of IPOs recently which impacts overall exit activity. Early movers can get the benefit of a re-rate (see Reddit) and IPO hopefuls would benefit from more liquidity in both private and public markets as more confidence returns to the market.

Fifth, while many local tech companies often look to the NASDAQ or NYSE as a listing destination but these exchanges are much more suitable for very large companies with market capitalisations exceeding US$5 billion to get the attention of investors and analysts. Biotechs may be able to get away with smaller market capitalisations. As Sam Weiss, Chair of Altium, noted recently in the Sydney Morning Herald on its $9 billion takeover by Renesas Electronics:

“The way I like to think about it is that it’s a demonstration that the ASX is a good home for technology companies. This company has spent 25 years listed in Australia, most of that time run from somewhere else. And throughout that time really less than 2 per cent of our revenue comes from Australia.

I would hope that it encourages other companies to go to the ASX because it has some real benefits. There is a pool of capital in Australia that is quite large, and you can access it through the ASX, so I hope it encourages people to knock on the door.”

Disclaimer: Please note that these are the views of the writer and not necessarily the views of Perennial. This article does not take into account your investment objectives, particular needs or financial situation. Some small changes were made to this article, based on updated information.