What is Better Future Investing?

Better Future Investing is the next generation of ESG investing.

The first generation of ESG investing was focused on minimising the harm associated with the operations of companies.

This typically involves using negative screens to exclude stocks that are involved in activities which cause harm, for instance, companies associated with fossil fuels, tobacco, alcohol and pornography. It also sometimes involves choosing the best ESG performers in each industry – for instance, seeking to invest in the major bank with the least ESG issues.

The next generation of ESG investing – Better Future Investing – still seeks to avoid harm. However, it is more focused on investing in companies that are making a positive contribution to a Better Future. Targeted industries include companies which are involved in healthcare, education, renewable energy, water remediation and improving efficiency.

Better Future Investing is keenly focused on investing in these companies while generating strong returns – something which is typically achievable given the strong growth outlooks for the companies involved.

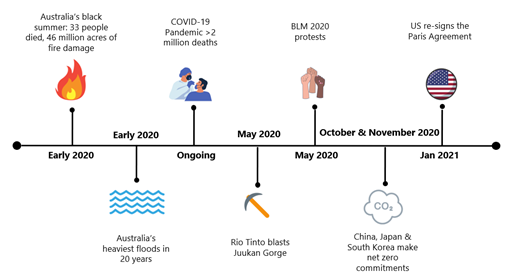

Why is ESG investing more in focus?

In Australia we have had the worst bushfires in a lifetime as well as devastating floods. Globally, there has been the devastation caused by COVID-19 and protests over social justice as part of Black Lives Matter movement. Meanwhile, there has been outrage over stock-specific ESG issues such as RIO Tinto’s blasting of the Juukan Gorge.

Wherever you have looked – natural disasters, COVID-19, social justice and ESG controversies have dominated the news headlines over the last 19 months.

Why does the public care about ESG investing?

As a result, more and more investors are seeking to invest in a way that not only minimises harm but also benefits from investing in companies that make a positive contribution to creating a Better Future. These companies have both business and investing tailwinds and typically have global growth prospects.

Where does Better Future Investing fit on the ESG investing spectrum

Better Future Investing – the next generation of ESG investing – is “ESG first” investing with a strong focus on finding companies that are making a positive contribution to a Better Future.

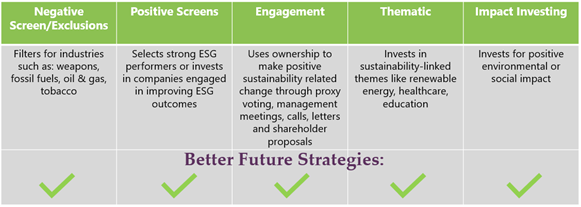

Types of Environmental, Social, Governance (ESG) investing

Better Future Investing uses styles from a number of areas associated with earlier generations of ESG investing, for instance:

- Use of negative screens to exclude companies operating in specified industries which cause harm. The most stringent funds have zero revenue thresholds – to exclude companies that receive any revenue from negatively screened activities.

- Engaging with the management teams of companies to encourage the companies to continuously improve their operations to drive outcomes that result in a Better Future. Engagement topics often include carbon emissions measurement, disclosure and targeting, encouraging gender diversity and improved corporate governance.

- Target positive environmental or social impacts as well as positive impacts more broadly.

Which key areas are targeted by Better Future Investing?

The areas targeted by Better Future Investing include healthcare, education, renewable energy, technologies that improve carbon emission efficiency and social welfare.

The Next Generation of Companies

The companies that Better Future Investing seeks to invest in are often disruptive technologies with interesting growth prospects – frequently these growth prospects are in global markets with large addressable markets.

Some examples of these companies that are held by the Perennial Better Future Strategies include:

Janison Education – an online examination platform that has global clients including the University of London and the OECD Pisa Test for Schools.

CleanSpace – which has designed lightweight and ergonomic Powered Air Purifying Respirators to protect workers in both industrial and healthcare settings. CleanSpace has clients in the US, Asia and Europe.

Calix – which has developed technology to separate carbon dioxide from the cement and lime production process. The cement and lime production process is a significant emitter of greenhouse gases. Calix is a key participant in Project LEILAC to validate the technology at scale with some of Europe’s leading cement manufacturers.

Better Future Investments

Making a positive contribution to creating a Better Future.

How do Better Future Investments perform?

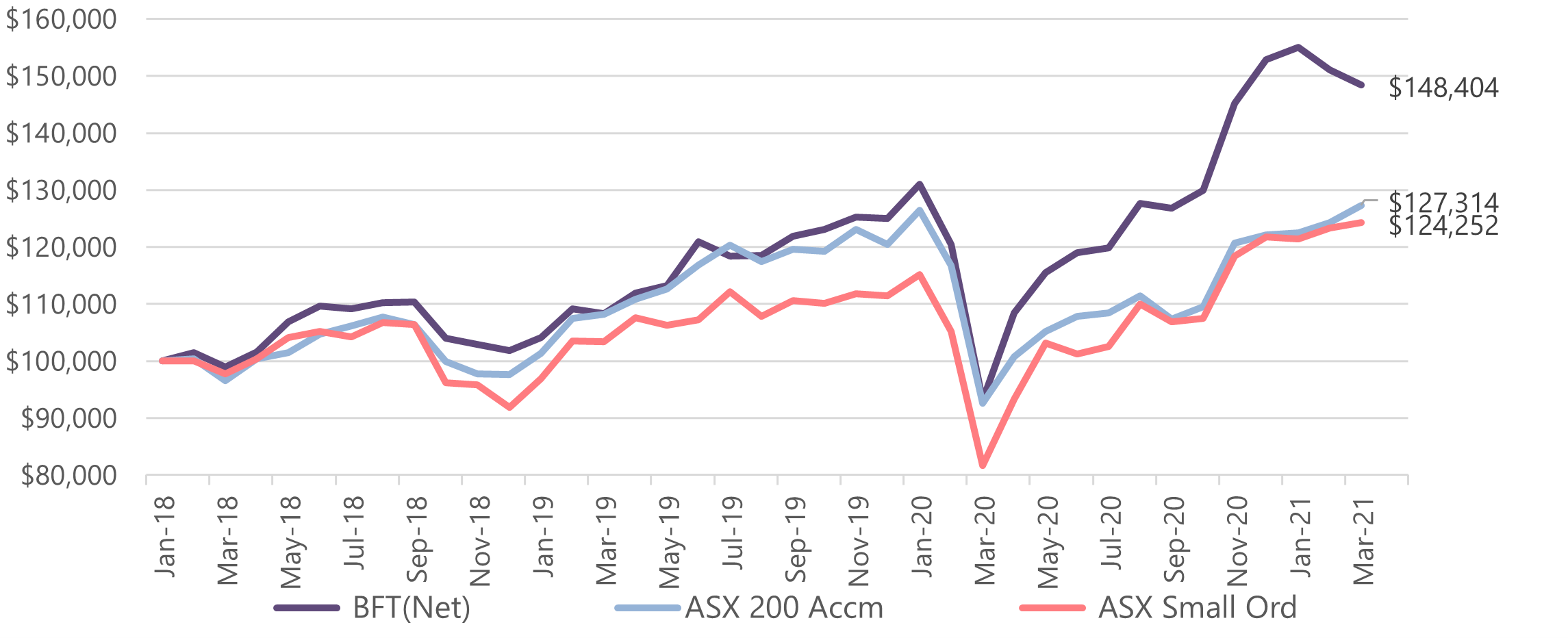

Better Future Investing is focused on delivering positive outcomes while generating strong returns. Often companies that are Better Future investments are small or mid-cap companies with good growth prospects which may result in strong returns.

For instance, here is a chart which compares the Better Future Trust – which invests in companies listed on the ASX or NZ Stock Exchange – to both the ASX Small Ordinaries Accumulation Index and the ASX 200 Accumulation index since inception over 3 years ago.

As you can see, $100,000 invested in the Better Future Trust has grown to $148,404 since inception on 1 February 2018, compared to the Small Ordinaries return of $124,252 and the ASX 200 return of $127,314.

Source: Perennial Value. As at 31 March 2021. Performance shown net of fees with distributions reinvested. Past performance is not a reliable indication of future performance. Perennial Better Future Trust inception date: 1 February 2018.

Why should I get onboard with Better Future Investing?

The aim of Better Future Investing is to deliver a “win-win” for both investors and future generations. Better Future Investing is for investors who:

- are seeking to invest in a way that avoids harm;

- are seeking to invest in a way that, more importantly, makes a positive contribution to a Better Future; and

- are seeking to generate strong returns from their investments.

Disclaimer: Please note that these are the views of the writer and not necessarily the views of Perennial Value. This article does not take into account your investment objectives, particular needs or financial situation.

Issued by: The Investment Manager, Perennial Value Management Limited, ABN 22 090 879 904, AFSL: 247293. Responsible Entity: Perennial Investment Management Limited ABN 13 108 747 637, AFSL: 275101. This article is provided for information purposes only. Accordingly, reliance should not be placed on this article as the basis for making an investment, financial or other decision. This article does not take into account your investment objectives, particular needs or financial situation. While every effort has been made to ensure the information in this article is accurate; its accuracy, reliability or completeness is not guaranteed. Past performance is not a reliable indicator of future performance. Gross performance does not include any applicable management fees or expenses. Net performance is based on redemption price for the period and assumes that all distributions are reinvested. Fees indicated reflect the maximum applicable. Contractual arrangements, including any applicable management fee, may be negotiated with certain large investors. Investments in the Trusts must be accompanied by an application form. The current relevant product disclosure statements, additional information booklet and application forms can be found on Perennial’s website www.perennial.net.au.