Recent broker reports have highlighted that the Australian Small Cap market is beginning to look stretched from a valuation perspective.

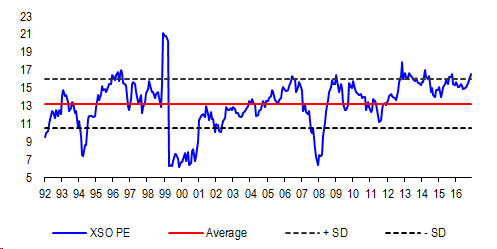

The chart below tracks the average P/E ratio of the Small Cap market over time and clearly shows that it is currently at elevated levels.

Forward P/E Ratio of Small Ordinaries over time

Source: Credit Suisse Nov 2017

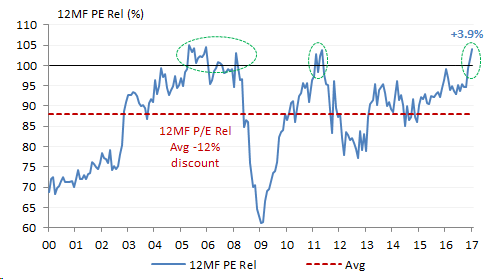

Small caps are also expensive when compared to large cap stocks in the chart below.

Forward P/E of Small Ordinaries relative to Top 100 companies

Source: Morgan Stanley Nov 2017

This data provides a helpful reminder to investors that with the currently elevated risk appetite in the market there is very little ‘margin of safety’ in some areas of the Small Cap market.

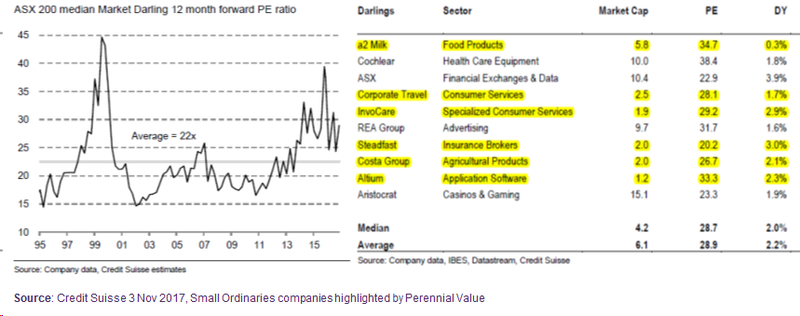

These risks are particularly apparent for investors in the current batch of ‘market darlings’ as identified in recent research by Credit Suisse (Small Cap stocks highlighted in yellow).

Many of these stocks have delivered strong returns for investors but their popularity has also pushed their valuations to elevated levels.

Stocks such as these have lifted the average valuation for the Small Cap Index (ASX Small Ordinaries Index). Indeed most of the excessive valuations are concentrated in the stocks which make up a meaningful part of the Index.

Looking at the Top 20 Small Cap Index (ASX Small Ordinaries Index) stocks, 11 have a P/E ratio over 20x with this group of 11 stocks having an average PE of 30x.

Moving down to smaller companies in the Index, a more encouraging valuation picture emerges. Furthermore, extending the search outside the index, to stocks down to a market capitalization of at least $50m, the universe of opportunities expands by a further 500 stocks.

As an example our current Small Cap portfolio of 56 stocks has an average PE of just 12x, a 26% discount to the market and below the long term average for the Small Cap Index.

It is in this area of the market that you can potentially find what may become the next market darling and stocks that have very little expectations priced into them – you just have to do more work to uncover them.

We are currently finding value in out of favor sectors such as health care, retirement, energy and smaller mining services companies.