Recent macro and capital market indicators should bode well for more exit activity whether in the form of acquisitions, IPOs or other liquidity solutions such as secondaries.

Capital Markets and Macro Pulse Check

As we head towards the end of 1Q2024, most global indices are outperforming. S&P 500 is up 8.3%, STOXX 600 up 3.3% and Nikkei 225 ripping to +17% while the ASX All Ordinaries is up almost 2% and reached over 8000, scaling all-time highs for the period to February YTD. Further, the Westpac-Melbourne Institute Consumer Sentiment index on Australia jumped 6.2% to 86 in February 2024, up from 81 in January which is the highest point in 20 months with expectations that the RBA has ended its rate tightening stance. Coupled with the RBA holding rates at 4.35% at its February meeting, consumer pessimism has seemingly reached a low point with more optimism in the outlook. The US February jobs report indicated robust job growth but coupled with a higher employment rate of 3.9% and lower wage growth than expected points to likely Federal Reserve rate easing sometime this year.

The Australian February earnings season also concluded with more earning beats than misses with Technology and Retail outperforming. A primary driver being companies reporting profits above expectations and this was rewarded with strong share price appreciation. The US February jobs report indicated robust job growth but coupled with a higher employment rate of 3.9% and lower wage growth than expected points to likely Federal Reserve rate easing sometime this year.

However, key swing factors for the market include: recession risks (although looking likely to be averted), global geopolitics (global wars and escalation risks), what happens in the ‘year of elections’ where at least 64 countries (and the EU) representing half the global population will be heading to the polls. Some of the key elections by population size include: India (April/May), EU (June), US (Nov), Indonesia (already concluded in February) and Pakistan (also concluded in Feb).

Countries with elections in 2024

Source: Time

ASX seeing more Capital Markets and M&A Activity Due to Lower Volatility and Rate Certainty

There has also been increased corporate activity, particularly on the ASX with both placements and M&A. Notable tech examples include Altium ($9.1bn takeover from Japanese chipmaker Renesas at >20x LTM Revenue multiple) and Ansarada’s acquisition by Datasite was announced (where profitability for bidders is still a focus with a loss making division being carved out). Larger industrials such as CSR and Boral also received bids as did dual-listed UK digital bank Virgin Money and renewables developer Genex Power. The ASX has also seen a flurry of placements, including for strategic purposes, such as in the case of Orica raising $400m to fund the acquisition of Cyanco and Metcash raising $325m for its bid for Superior Foods. There were also some founder led selldowns, such as Cettire and Data Dicker.

We saw more muted IPO activity in 2023 but many companies delayed their 4Q offerings last year and most are yet to make a play. Year to date, only copper miner, Metals Acquisition Corporation, IPOed raising $325m (upsized) but this was more of a secondary listing given it was already NASDAQ-listed and the deal was offered at an enticing 10% discount. Civil mechanical and electrical engineering services company, Tasmea, is hitting the road for a potential A$60m IPO. A more certain macro environment and less volatility in the listed markets may see more listings on the ASX in 2H2024. On the demand side, listed managers will also want to see ‘new ideas’ as recent take privates have seen many quality names delist and some sectors without obvious comps. For now, we will look to the US where Reddit is set to list shortly at a mooted US$6.5bn valuation (35% discount to its last private valuation in 2021) and at a mid single digit revenue multiple). A large pipeline including Stripe, Klarna and Turo may test the market ahead of US elections in November.

Fund Realisations and Exits Becoming More of a Focus

Fund realisations are now top of mind for many Australian venture funds, especially those with early 2010s vintages nearing their end of life. Unlike their private equity cousins, portfolio exits were not as high on the agenda for Australian VCs in recent years given:

- the stage / vintages of the funds with more back-ending of returns when investing in very early stage companies;

- desire to compound returns for as long as possible; and

- free flowing capital during the ZIRP era where it seemed the only way valuations could go was up.

Note in the discussion below, Limited Partner (LP) and General Partner (GP) terminology will be used interchangeably with investor (institutional, family office, HNW) and fund manager respectively, given venture and private equity funds are traditionally set up with partnership structures. In addition, the secondary market has been more developed with these fund structures, although other structures like unit trusts and SPVs do also participate and initiate secondary deals.

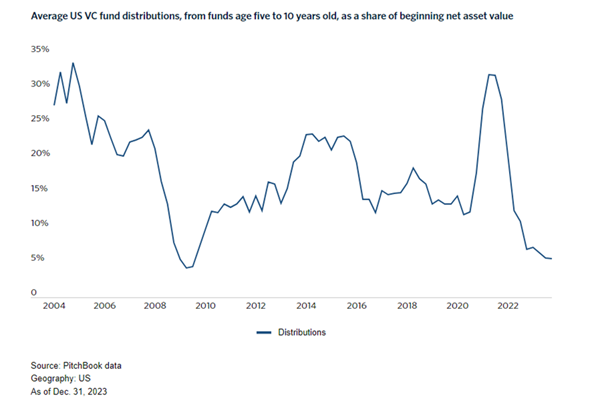

In order for GPs to raise new funds, investors are zeroing in on capital returns in a slower exit environment. No longer happy with paper returns, LPs are a key force in driving the private market sector’s focus on exits as those funds that have a history of providing DPI (distributions to paid-in capital). According to Pitchbook, distributions for US VCs have been the lowest since the GFC:

LPs also have their own liquidity constraints. The denominator effect is also at play, where many allocators of capital have become overweight to alternative assets given corrections in the public markets. However, in the private markets, where valuations can lag, these assets in some cases have not corrected as quickly or as far, resulting in investors needing to ‘re-balance’ their portfolios. This has also been compounded by existing “commits” to funds and with a slower distribution environment, LPs are drilling into DPI and in some cases even structured solutions to unlock cash.

Growth of the Secondary Market

According to Bain & Company’s Private Equity Report 2024, secondaries have grown from a US$25bn market to US$110 billion in 2023.

The various types of secondaries include:

- Direct secondaries – involves direct transfers in a private company from one investor to another and may require approval processes especially if the shareholding is governed by a shareholders agreement.

- LP-led secondaries – where LPs sell a stake in a fund to another investor. This can involve the sale of positions in one or more funds which is managed by the same or different GPs.

- GP-led secondaries – where GPs initiate the process of transferring assets from an older fund into a new vehicle to give existing LPs the option to cash out or roll over into the new vehicle.

Local Direct Secondary Activity Continues…

Locally, in direct secondaries, we have seen Canva’s recent US$1.5bn secondary trade announced in January 2024 ahead of a mooted 2025 US IPO and Employment Hero wrap up a secondary alongside a capital raise which also included a continuation fund vehicle. Eucalyptus also reported a founder/employee secondary to an un-named offshore investor. All the aforementioned trades were at the same valuation as their last documented third party raises / trades indicating a clear market for secondary shares from new and existing shareholders in well known private companies.

…and Asia Pacific Secondary Specialists See Robust Activity In This Area

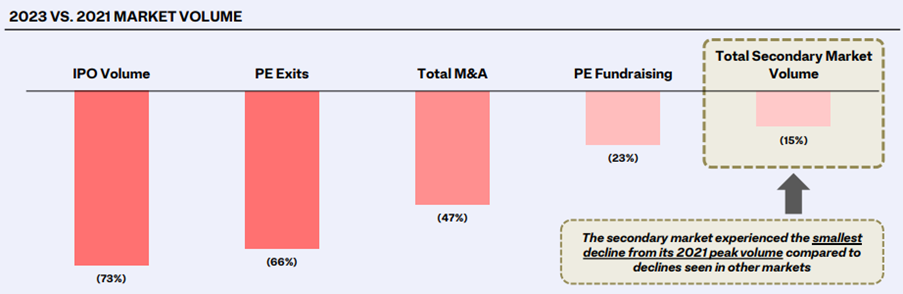

According to PJT Partners FY2023 Secondary Market Insights, based on both LP and GP interviews, traditional LPs are looking to increase active participation in the fund continuation vehicle market as LPs can ‘actively solve their own problems’ and over 80% of GPs surveyed would also look to opportunistically utilise fund continuation vehicles over the next 2 years. A driver for secondaries is mainly due to a depressed exit environment as can be seen for 2023 versus 2021. In the case of private equity, PJT shows this has impacted both exits and fundraising. By comparison, while the secondary market also experienced a decline, this at a much smaller decline relative to other exit pathways.

Source: PJT FY2023 Secondary Market Insight

Secondary markets have also been favouring buyout strategies given growth and venture are seen as emerging asset classes with lower transaction volumes and the perception of being more difficult to price. PJT PCS expects that pricing will continue to improve over the course of 2024 as secondary investors adjust their cost of capital and reflect improved distribution profiles into their pricing

From an LPs perspective, secondaries can be a useful tool for portfolio management, enabling liquidity so they can commit to new fund vintages. Also prior commits can create a cash need and LPs can now actively manage their cashflow versus waiting for distributions in slower markets. According to Gateway Private Markets, secondaries provide LPs an opportunity to access high quality assets and priority GPs. Commenting on key trends in 2024, Rachel Wong Troublaiewitch, CEO of Gateway Private Markets, says:

“In the evolving macroeconomic landscape, alongside the increasingly nuanced needs of institutional investors, secondary markets have emerged as a strategic avenue for unlocking liquidity in high-performing assets. This has started attracting significant attention from institutional LPs in Asia. Continued market education on how to effectively leverage secondary markets through direct secondaries and LP-led transactions, and understanding their importance for effective portfolio management, will be critical as Asia’s relevance continues to rise.”

What Does a Slower (But Improving) Exit Environment Mean?

Dialogue with both companies and investors will be important as founders, fund managers and investors do not want to exit into a relatively depressed environment (although this year has started with signs of life). It will be important to align and set expectations with founders and investors on exit horizons with the common goal of maximising value and / or optimising for liquidity.

Fund managers will be looking at ways to creatively position their portfolio for an exit as IPO windows can open quickly and strategic buyers can appear especially with increased confidence across the market to transact. Preparation is therefore needed to preserve optionality. Funds and investors can also proactively and creatively generate liquidity through secondaries and structured solutions alongside more traditional exit pathways for their portfolio companies.

Disclaimer: Please note that these are the views of the writer and not necessarily the views of Perennial. This article does not take into account your investment objectives, particular needs or financial situation. Some small changes were made to this article, based on updated information.