Fairlight Asset Management has partnered with Perennial to offer Australian investors a global small and mid cap equities fund, a strong complement to Perennial’s highly regarded Australian small and micro cap offering.

Fairlight is focused on contributing to superior investment outcomes for clients through exceptional performance. The team takes an ethically aware, quality-driven approach to investing, dedicated to deep fundamental research of both the quantitative and qualitative aspects of investee companies.

Fairlight believes that;

- Global markets complement ASX sector weights

- Smaller companies outperform over the long term

- Combining quality characteristics of smaller companies can help to lower overall volatility of returns for investors

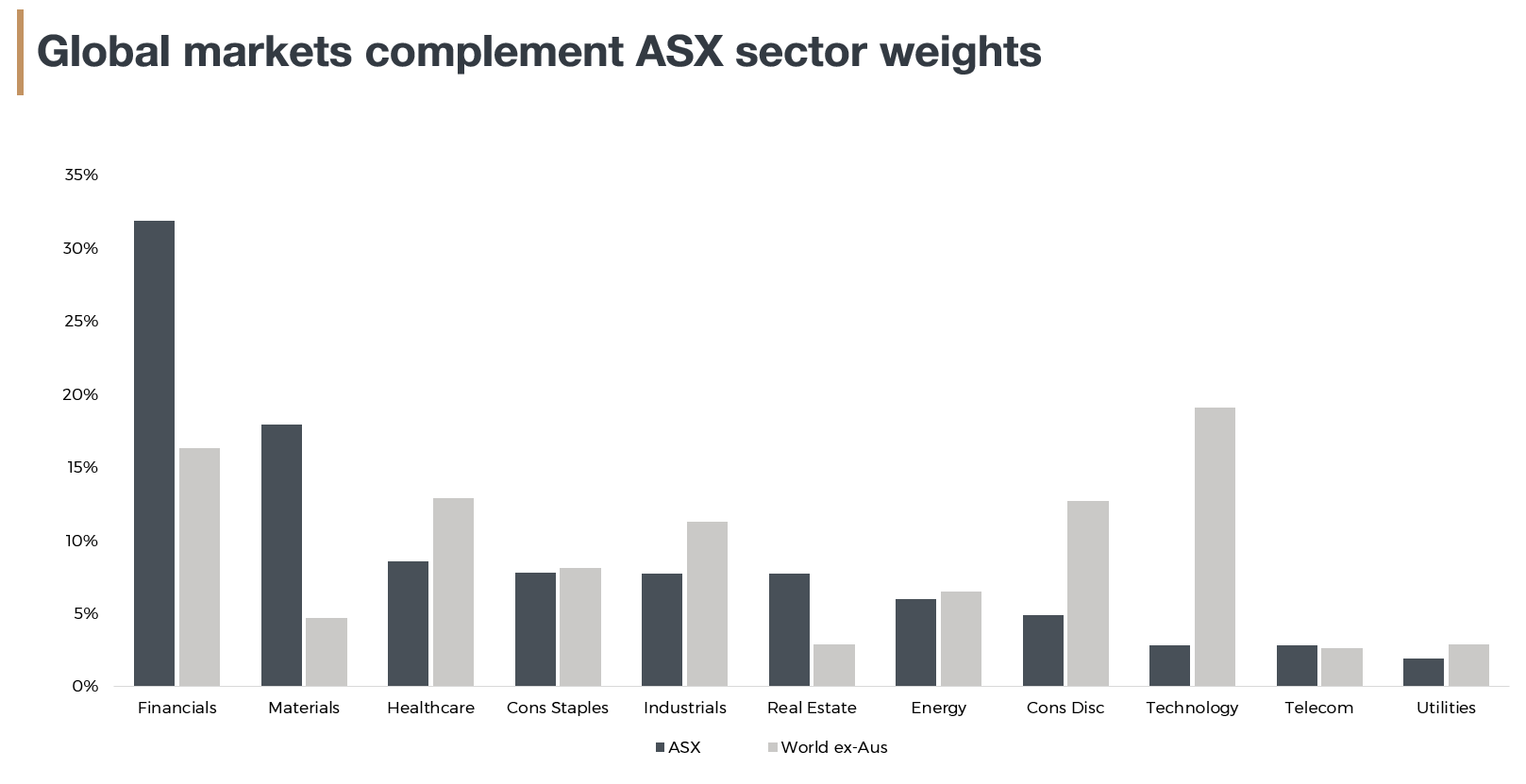

Global markets complement ASX sector weights

Australia is rich in high quality materials and financial companies but is less well represented in other sectors such as healthcare, industrials, consumer discretionary and technology. Fairlight believes some of the best global franchises can be found in these sectors, and that by taking a global approach to investing, domestic investors may benefit from a more diversified and resilient portfolio.

Sources: Vanguard Australian Shares & MSCI International Shares Index ETF Factsheet, 30 September 2018

Sources: Vanguard Australian Shares & MSCI International Shares Index ETF Factsheet, 30 September 2018

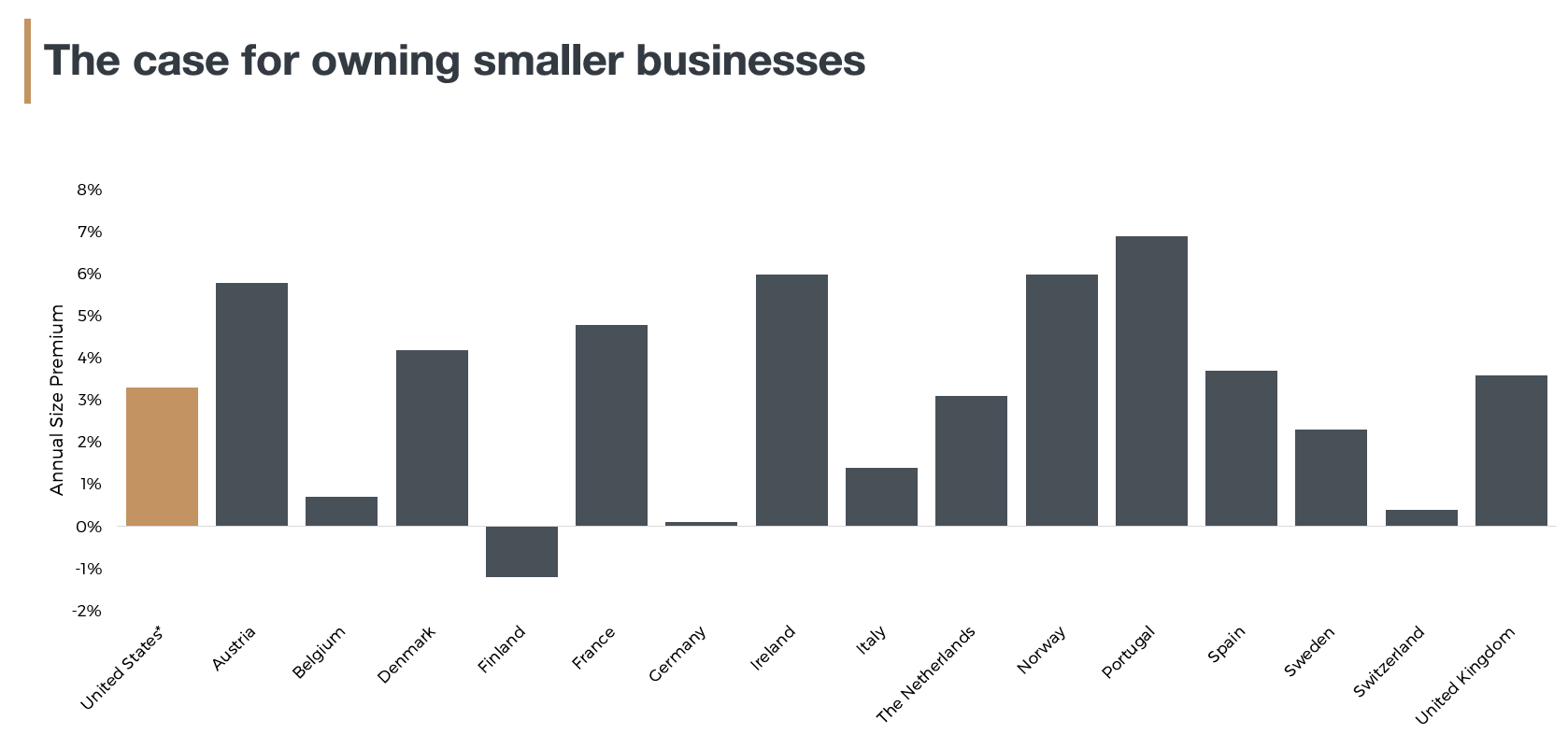

The case for owning smaller companies

From 1927 through 2015, the return premium earnt by investing in U.S. small capitalisation companies relative to U.S. large capitalisation companies has been 3.3% (Andrew Berkin, 2016). While less historic data exists for other markets, a dimensional analysis of 15 European markets found an average return premium of 2.4% to small companies over the period 1982-2014 (Stanley Black, 2015):

Figure 1 – Size premia across various markets, U.S. 1927-2015 (Andrew Berkin, 2016), Europe 1982-2014 (Stanley Black, 2015)

Figure 1 – Size premia across various markets, U.S. 1927-2015 (Andrew Berkin, 2016), Europe 1982-2014 (Stanley Black, 2015)

There are good reasons for believing that small company return premium is real and should be expected to persist:

- The return premium is pervasive having been identified in the U.S., most European markets and to a lesser extent, emerging markets as well.

- The return premium is persistent having statistical significance in the U.S. over the longest period for which data is available (1927 through to today).

- The return premium is intuitive as smaller companies are able to grow faster and have a longer runway to compound growth given the more modest starting point.

- The return premium is structural as smaller firms exhibit greater mispricing due to less sell-side coverage.

- The return premium is compensative for lower liquidity and less diversified business models.

The case for owning quality companies

In the U.S. from 1927 through to 2015, highly profitable quality firms returned 3.1% per annum more than the least profitable firms (Andrew Berkin, 2016). Novy-Marx (2013) showed that the outperformance of high profitability stocks was not limited to the U.S. but rather is pervasive across all the major developed markets.

Figure 2 – Quality premia across various markets, U.S. 1927-2015 (Andrew Berkin, 2016), Europe 1982-2014 (Stanley Black, 2015)

Figure 2 – Quality premia across various markets, U.S. 1927-2015 (Andrew Berkin, 2016), Europe 1982-2014 (Stanley Black, 2015)

Why combine small and quality?

Of particular significance for investors in SMID capitalisation companies, Wang and Yu (2013) were able to demonstrate that the quality return premium is significantly larger (up to four times as much) at the smaller end of the market. While small quality stocks outperform large quality stocks, and small junk stocks outperform large junk stocks, the unfavourable exposure of the smaller company universe to more lower quality companies obscure a considerable portion of the advantage of small company investing.

A study by AQR Capital (2018) normalised the small company universe for quality and found the small company return premium to be:

- Much stronger, and vastly improved the risk (as defined by volatility) adjusted returns of the portfolio;

- More stable, eliminating the observed underperformance in 1980s and 1990s;

- Exhibiting a linear relationship between size and returns;

- Evenly distributed across all months of the year; and

- Uncovered in international markets where it was previously unobserved.

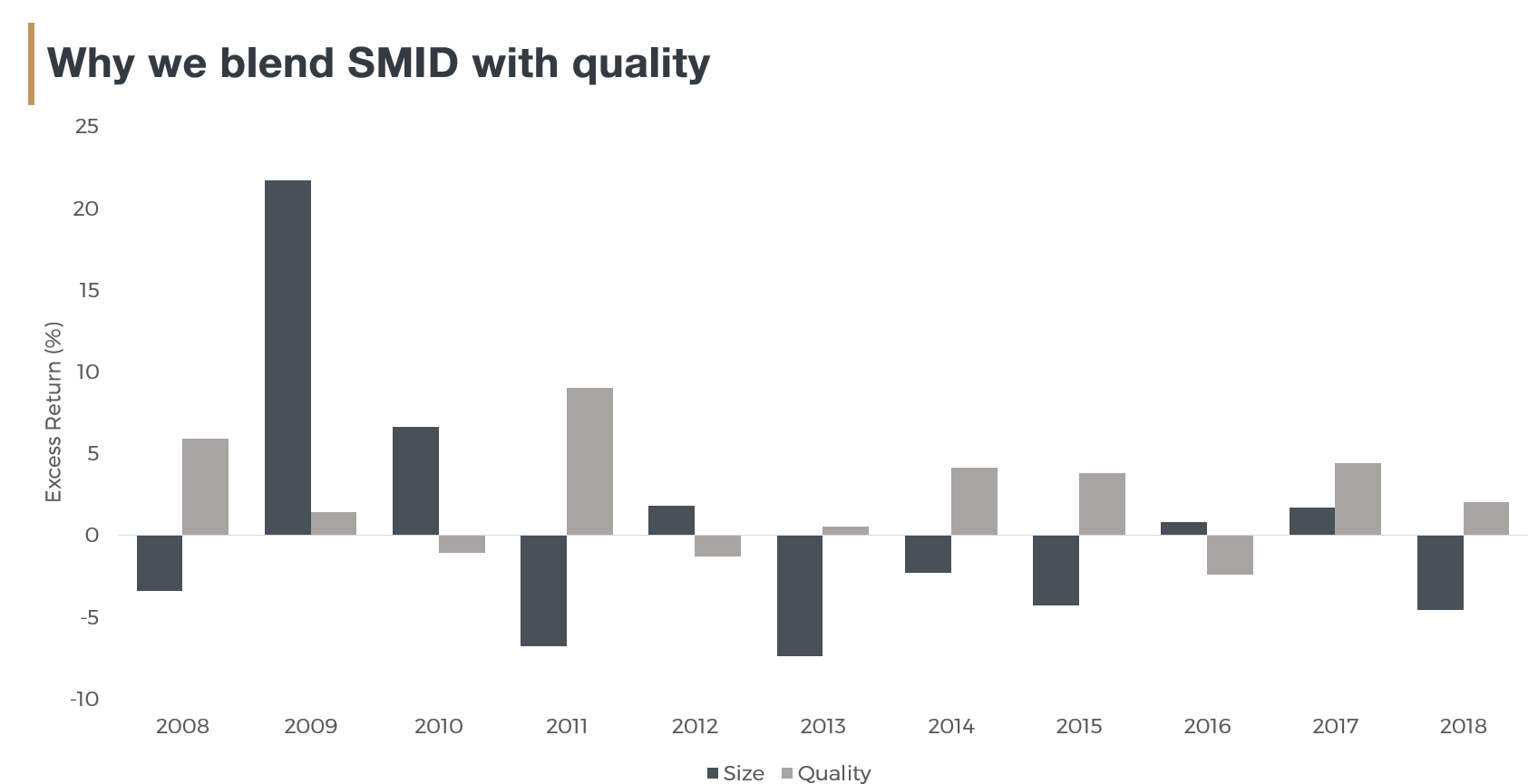

Pleasingly for investors, size and quality characteristics also tend to show a diversification benefit. When markets face pressure, smaller companies often perform poorly, however in such scenarios there is a tendency for investors to seek protection in higher quality securities. Over the past decade there has not been a year where both quality and size underperformed simultaneously; ultimately providing a lower volatility experience for investors.

Source: MSCI. Returns are relative to MSCI ACWI Index in USD

Source: MSCI. Returns are relative to MSCI ACWI Index in USD

For more details regarding Fairlight’s approach to investing in global markets, please download a copy of the Fairlight Investor Handbook and visit their website.

The information in this article (Information) has been prepared by Fairlight Pty Ltd ACN 628 533 308 Corporate Authorised Representative No 001267604 of AFSL No 238198 (Fairlight or we or us).The Information is only for investors who qualify as wholesale clients under sections 761G or 761GA of the Corporations Act 2001 (Cth) or to any other person who is not required to be given a regulated disclosure document under the Corporations Act. The Information is not investment advice. It is general information only and does not take into account the investment objectives, financial situation or particular needs of any prospective investor.The Information is not a recommendation to invest. Before you decide to invest in the Fairlight Global Small & Mid Cap (SMID) Fund (Fund), it is important you first read and consider the Fund Product Disclosure Statement dated 15 October 2018. Copies of the PDS are available from The Trust Company (RE Services) Limited, ABN 45 003 278 831, AFSL No 235150 as issuer of the PDS, or from Fairlight. You should consider the PDS before deciding whether to invest, or continue to invest, in the Fund.Neither Fairlight, nor any of its directors, associates or related entities, guarantee the performance of the Fund or the repayment of capital or any particular rate of return. Whilst we believe the material in this website is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded.