Higher interest rates have proven not to be a dealbreaker for M&A in 2022. What are the latest trends being observed in the market and how can we as investors stand to benefit?

Most of us will have felt the very tangible effects of higher interest rates in recent months, whether that be increased mortgage repayments or more interest income in our bank accounts. Companies are also being impacted, yet, like us as individuals, the impact could be negative, or it could be positive.

Throughout 2022, one positive impact we have witnessed in an otherwise challenging market is resilient mergers & acquisitions (M&A). While conventional wisdom would point to higher interest rates being restrictive for M&A, in contrast we have seen robust deal activity, and especially so in certain sectors.

Before we focus on our local market, let us cast our eyes to the United States, where global trends often begin and end. While US M&A activity in aggregate is below the heydays of 2021, it remains healthy, and especially so in the health care and technology sectors. In fact, health care M&A is on pace to be highest on record, while tech is run rating at levels not seen since 2016. But here’s the catch, these metrics are based on deal count and not deal value, with 2022 aggregate deal value well below recent years in all sectors. In essence, deals are being done, they’re just smaller. As you’d imagine, we quite like this dynamic because our focus is firmly on small companies. Health care, biotech and tech have also typically required supportive equity markets to raise capital for funding longer-dated growth aspirations. As such, it’s not a surprise to see most of the deal activity concentrate in sectors that currently require the most external capital.

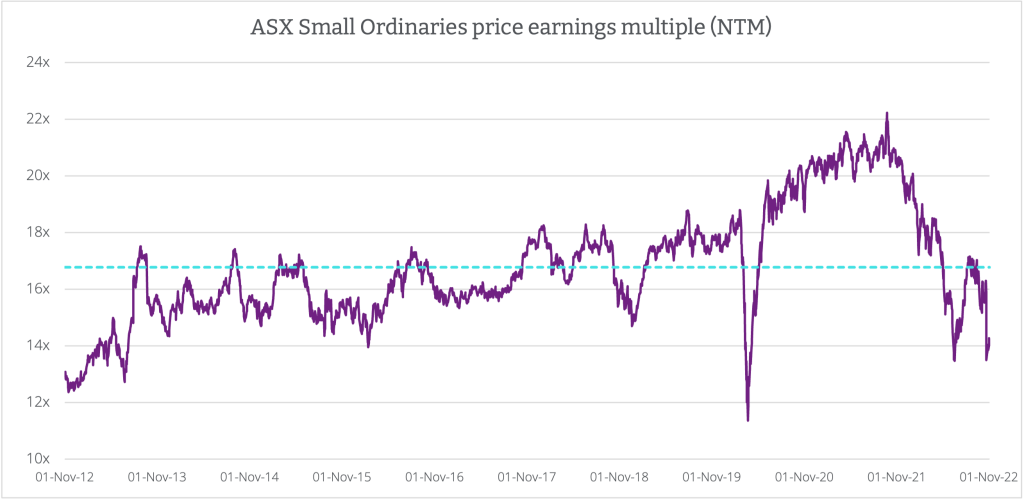

There are a few reasons why it’s likely M&A will stay healthy into 2023, notwithstanding an uncertain global macroeconomic outlook. For one, company balance sheets remain healthy in aggregate. We wrote about this dynamic late last year, and things haven’t materially changed on this front. What has changed is valuation, with the ASX small ordinaries trading at levels not seen since the depths of our first Covid-19 crisis in March 2020, and prior to this since 2013.

Secondly, smaller deals are inherently less risky, making them particularly suitable for the more volatile markets we’re experiencing at present. In fact, a recent Mckinsey research paper found that small to mid-sized programmatic or ‘bolt-on’ acquisitions generated the most excess total shareholder return in the decade ending 2019. With a weaker Australian dollar, we are not surprised to see Australian ‘bolt-on’ assets being bid for by their larger offshore peers, with recent examples in the aquaculture space being salient examples. While M&A has a patchy track-record of enhancing shareholder value, markets have consistently rewarded acquirers for pursuing M&A in the short-term (as measured by their 1-day share price move post deal announcement). This will further embolden management of well-funded companies to engage in M&A.

Lastly, private equity and venture capital dry powder (which is capital raised but not deployed) are at record highs and private capital fundraising in 2022 remains solid. As such, it is no surprise to see private equity become more active in the local market, taking advantage of operationally well-run businesses trading at attractive valuations. Recent examples include KKR’s offer for Nitro (NTO-ASX) and the recently announced non-binding indicative offer for Readytech (RDY-ASX), which we own in our smaller company portfolio.

While both deals are currently live and ongoing, they serve as a good reminder that value and price are often distinct from each other, especially so when markets turn volatile, and valuation multiples compress. As Warren Buffet opines, “price is what you pay, value is what you get.” We spend our time buying value at the right price.

How can we as investors stand to benefit? One method would be to opportunistically take advantage of shorter-term market gyrations and invest with a more patient and strategic perspective, consistent with acquirers, be they private equity or strategic buyers. Yes, the global macroeconomic backdrop is challenging, luckily buying value at the right price remains in vogue.

By Marco Correia, Deputy Portfolio Manager, Perennial Value Smaller Companies Trust

Disclaimer: Please note that these are the views of the writer and not necessarily the views of Perennial. This article does not take into account your investment objectives, particular needs or financial situation. Some small changes were made to this article, based on updated information.