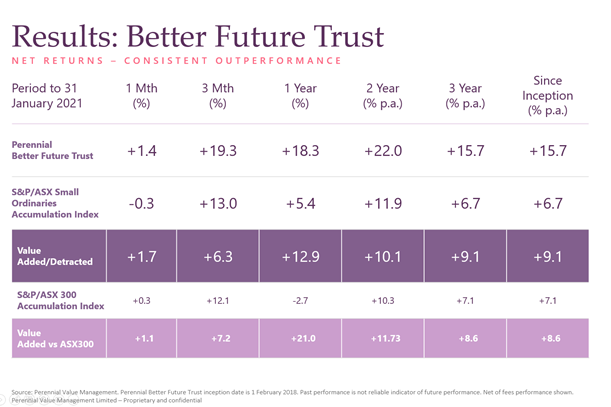

Perennial’s true to label ESG sustainable portfolio the Perennial Better Future Trust has achieved its 3-year track record with solid performance across all time periods. The fund is up 15.7% p.a. after fees since 31 January 2018 and up 18.3% over the year to 31 January 2021.

The fund aims to deliver strong, consistent returns to investors while contributing to a better future.

Damian Cottier, Portfolio Manager, says “When we set up the fund 3 years ago, our goal was to demonstrate that there is no performance trade-off to invest with a focus on sustainability and ESG. We are pleased that we have been able to deliver on this goal over the first three years, through a variety of market conditions including the disruptions from COVID.”

The fund, which was formerly known as the Perennial Smaller Companies Sustainable Future Trust, has recently changed its name to the Perennial Better Future Trust. The new name aligns more closely with our goals for the fund.

We seek to invest in companies that have a positive impact on the environment and society, with a focus on investing in companies that derive a majority of their revenues from:

We also have a negative screen with a zero-revenue threshold. We do not invest in companies that to our knowledge receive any revenue from:

We have recently released our first Impact Statement on the companies held in the portfolio during the 2020 calendar year.

The statement outlines our contribution to the United Nations Sustainable Development Goals, our sustainable theme exposure, our positive impact on the environment and society and provides a description on some of our holdings that are contributing to a better future.

Read our Impact Statement 2020 here.

Disclaimer: While the information contained in this article has been prepared with all reasonable care, Perennial accepts no responsibility or liability for any errors, omissions or misstatements however caused. This article is not personal advice and does not take into account your investment objectives, financial situation or needs.

Perennial Investment Management Limited is the responsible entity for the funds mentioned in this article. Potential investors should consider the product disclosure statements of the funds mentioned in this article before deciding whether to invest, or continue to invest, in the funds. The product disclosure statements and more can be found on Our Trusts page.