Read the original article on AdviserVoice.

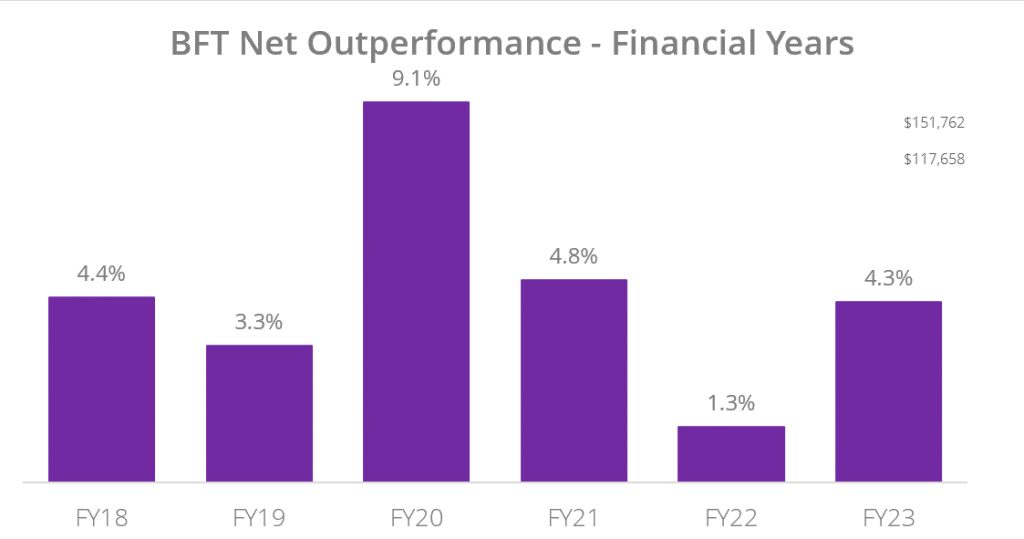

The Perennial Better Future Trust has outperformed its benchmark each financial year since inception, now including five consecutive financial years, laying to rest the claim that sustainable investing compromises investment returns.

At the conclusion of the financial year June 30 2023, the Trust outperformed the S&P/ASX Small Ordinaries Accumulation Index (benchmark); returning 12.7% net of fees, outperforming the benchmark by 4.3%. The Trust has delivered 8% per annum since inception net of fees, outperforming the benchmark by 4.9% per annum.

The Trust’s performance has been largely stock specific including strong performance from Telix Pharmaceutics (ASX:TLX), Alpha HPA (ASX:A4N) and long-term contribution from Calix (ASX:CLX).

Perennial Better Future Trust Portfolio Manager, Damian Cottier says: “In a difficult market environment, the authentic investment process we have built has demonstrated yet again that there is no performance trade off investing in this sustainable way.”

The Trust’s actively managed portfolio seeks to generate strong and consistent returns while only investing in companies that have proven through a proprietary scoring system, that they are positively shaping a better future.

These companies sitting within the portfolio are typically in industries such as healthcare, education, renewable energy, and low carbon technologies.

Cottier says: “These industries are positively geared to benefit from strong global tailwinds, expected to continue into the new financial year and beyond.

There is no doubt it has been a challenging environment for both smaller companies and industrials more generally the past financial year, as such, the outperformance was largely driven by stock selection, with the below highlighting why Telix Pharmaceutics (ASX:TLX), Alpha HPA (A4N) and Calix (ASX:CLX) were amongst the high performers.”

Telix Pharmaceutics (TLX.ASX) had a series of positive news. The global sales of its Illucix product for the imaging of prostate cancer continued to exceed market expectations.

The initial sales outcomes suggest there is significant demand for the product and urologists are seeing patient benefits from the technology.

The company also announced the completion of patient recruitment for the company’s Phase III renal (kidney) cancer imaging study.

The product, which aims to distinguish between benign and malignant renal lesions, had previously received “Breakthrough Designation” from the U.S. Food and Drug Administration (FDA). Current imaging cannot reliably make this distinction, leading to invasive biopsy procedures that are not always necessary as up to 80% are not malignant.

Alpha HPA (ASX:A4N) specialises in low cost, low carbon, high purity alumina. These ingredients have applications mostly across lithium-ion batteries, semiconductors, and LED lights, all critical to decarbonisation.

Earlier in the year Alpha HPA announced it reached an agreement with Austrian based global industrial company Ebner Industrieofenbau Gmbh, to enable Alpha to produce synthetic sapphire glass which is a downstream product of the company’s high-purity alumina (“HPA”) production process.

This agreement will result in the production of value-added product in Australia at the company’s Gladstone, Queensland production facility using Ebner’s low-energy technology and Alpha’s high-purity alumina (“HPA”). Alpha’s production process results in HPA which has around 70% lower total emissions compared to incumbent processes.Calix (CLX. ASX) has been a key contributor over the last few years. It is an industrial solutions company dedicated to solving global sustainability challenges, including;

- The company’s LEILAC technology assists in CO2 mitigation in the global lime and cement industry which is responsible for ~9% of global emissions. Partners include Heidelberg Material, Cemex and Adbri.

- Joint Venture with Pilbara Minerals for more efficient and less carbon intensive processing of lithium ore.

- Adapting the core LEILAC technology for other applications with support from government agencies globally including Zero Emissions Steel, sustainable marine and aviation fuels and zero emissions shipping.

Cottier concluded, “It is pleasing to be able to display through performance that an authentic and differentiated approach to sustainable investing is an achievable strategy for investors, wanting to bridge the gap between sustainability and returns.”

*Past performance is not an indicator of future performance.

Disclaimer: Please note that these are the views of the writer and not necessarily the views of Perennial. This article does not take into account your investment objectives, particular needs or financial situation. Perennial Investment Management Limited is the responsible entity for the funds mentioned in this article. Potential investors should consider the product disclosure statement and target market determination of the fund mentioned in this article before deciding whether to invest, or continue to invest, in the fund. The product disclosure statement and more can be found on Our Trusts page.