The word “tension” generally has negative connotations, but tension can actually be a positive driver in the private markets for both investors and companies. Tensions involve competing demands, which result in better decision-making, more creativity, and innovative solutions. In 2023, some of these tensions are brought to the fore.

Private Capital or Public Markets?

In recent years, there has been a flood of capital into the private markets, enabling companies to ‘stay private for longer’. This has shifted the discussion to companies potentially staying private forever on the assumption that the private market exists to fund these companies into perpetuity. However, the tension here is that unless a business is profitable, it is more likely than not that there are third party capital investors who not only require a return on their capital but also a liquidity event, often within a set time horizon. So a clear distinction is required to be made between “patient” and “forever” capital.

Recently, IPOs have received negative press due to the perceived value destruction upon listing (but this is also partly attributed to broader market volatility), poor aftermarket performance, increased time commitments, continuous disclosure obligations, and cost burdens from maintaining a listing. However, a listing has many benefits including:

- Instant liquidity for all shareholders which includes founders, existing investors, and employee shareholders and also a daily marker on valuation.

- Reputation and signaling benefits as a listed company is synonymous with being more trusted given the higher governance requirements as well as audited accounts, which are important for customers, suppliers and employees.

- Acquisition currency and the ability to raise capital quickly to execute growth plans.

The common thread right now is that the bar is high for capital from both private and public markets. The best funding or exit path for a company can be pursued because these two options exist in the first place for founders to weigh up the costs versus benefits.

Striking the Balance: Growth vs. Profitability

Investors require companies to grow in order to realise a return on investment but with the era of ‘cheap money’ gone, herein lies the tension of growth and profitability. Capital is required to grow a business and also execute on ‘experiments’ which could be product improvements and research & development that result in finding alternate sources of revenue streams. The availability of capital in 2023 is scarce, and founders are finding that they need to cut back on growth to ensure their business model is sustainable. The tension here is to find the balance of continued growth but not at the expense of profitability. With less capital availability, founders need to be more capital efficient and thoughtful on how capital is deployed to ensure there is a strong return on investment. In 2023, this tension has resulted in many companies being able to streamline operations while maintaining and growing their topline, resulting in a far more efficient and scalable business.

To raise or not to raise?

Many companies are not looking to test the markets for a capital raise in the current environment with falling valuations in the private markets and supply and demand now in the favour on the supply side.

Capital Demand Now Up to 3.5x Capital Supply

Source: Pitchbook

This is especially the case if companies raised in the heady days of 2021 at sky-high valuations have yet to grow into their valuation. For some companies, there is no choice to raise. For investors, it is a great time to be deploying into a market with sensible valuations and limited competition, but they also face the tension of how far to go with valuation and structuring. Investors need to also be fiduciaries for their investors but over structuring can set a precedent and also be negative signaling for a company looking to raise their future round of capital. Founders would also push back on certain terms. The tension here is to find a balance between founder and investor expectations, which would ultimately result in a win-win for both sides as more capital to a founder means capital to ‘live another day’ and fight the scale-up battle or more capital to get ahead of the competition.

To allocate or not to allocate?

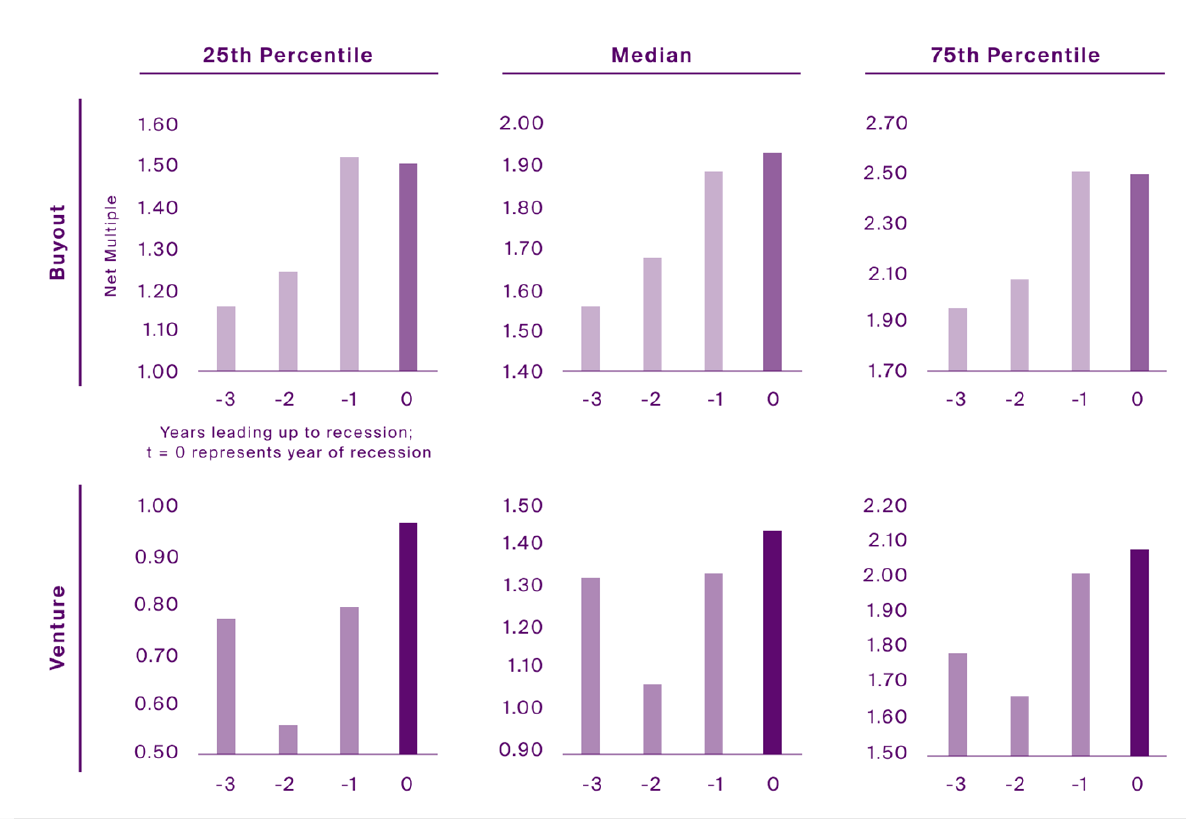

Investors also face the tension of allocating or not allocating their capital in uncertain times. To stay on the sidelines would ensure no loss of capital, but it also means investors miss out on opportunities. To put money to work may feel risky, but this is the business that investors are in – to manage the risk and reward profile. To take the big picture, investors who were out of the market post-GFC missed out on great opportunities and fund vintages that actually outperformed. While tempting in this environment to do nothing, the tension of missing out drives the need to put capital to work but sensibly and with downside protection.

Private Capital Vintage Performance

Source: CAIS 2023, Preqin, Private Capital Benchmarks 25th percentile, median and 75th percentile net multiple for Buyout – All, Venture – All and Real Estate – All, using most-up-to-date data, as of 12/2022. Recession periods represented by NBER methodology, net multiple depicted is the average net multiple between vintages for the same t value, utilizing recession years 2001 and 2008-2009.

Final Thoughts

Accordingly, it is incumbent on private companies as well as investors to manage the tension of competing demands to find the pockets of opportunity. In a capital constrained environment, it is important to keep all options open.

By Karen Chan, Portfolio Manager, Perennial Private Investments

Disclaimer: Please note that these are the views of the writer and not necessarily the views of Perennial. This article does not take into account your investment objectives, particular needs or financial situation. Some small changes were made to this article, based on updated information.