Responsible and ethical investors reap greater rewards, and COVID’s no exception – new RIAA report

Companies which look after their employees, minimise their impact on the environment, have good governance and protect human rights across supply chains are more likely to deliver superior financial returns to investors, the landmark annual study from the Responsible Investment Association Australasia (RIAA) has found.

The new RIAA report researched in collaboration with KPMG, the Responsible Investment Benchmark Report Australia 2020 (the Report) shows that in 2019, Australian and multi-sector responsible investment funds outperformed mainstream funds over 1, 3, 5 and 10 year time horizons. Further analysis shows the outperformance has continued amidst the major market disruption brought on by COVID-19.

The Report reveals Australia’s responsible investment market continued its upward trajectory in 2019, with $1,149 billion in assets under management, a rise of 17% from 2018. Responsible investment now represents 37% of Australia’s total $3.155 trillion in professionally managed assets.

This growth reflects the preferences of consumers, as a RIAA study released earlier this year found the overwhelming majority of Australians now expect their savings (87%) and superannuation (86%) to be invested responsibly and ethically.

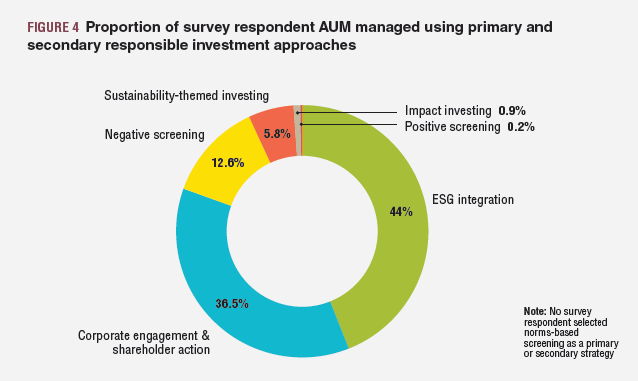

Consideration of environmental, social, governance (ESG) factors is now the expected minimum standard of good investment practice, with $1 trillion of Australia’s AUM managed using ESG integration as a primary approach. This approach is closely followed by corporate engagement and shareholder action. Negative screening remains an important responsible investment strategy, and weapons, tobacco, gambling and pornography are the most frequently screened categories.

The Report also shows that the market for impact investments has continued to develop significantly, growing by 249% from 2017 to 2019 and increasing in size from $5.7 billion as at 31 December 2017 to $19.9 billion as at 31 December 2019.

The RIAA Benchmark Report is the most comprehensive review of the responsible investment sector in Australia. Read the Report here.

Of the 165 investment managers assessed in the study, just 44 (27%) are practising a ‘leading approach’ to responsible investment. Disclosure of fund holdings remains a key area for improvement, with 36% of investment managers not making any public disclosure of their holdings.

The key attributes that leading practice investment managers demonstrate in their investment process include:

- the availability and detail included in their ESG investment policies;

- integration of ESG factors in valuation and asset allocation;

- clearly defined approaches to stewardship;

- active ownership (including corporate engagement and voting);

- applied screens to reduce downside risk and tilt towards solutions; and

- meaningful disclosures about these aspects of their investment approach.

Perennial is extremely proud to be recognised as a leader in responsible investment in the Report (a score of 75% or greater on the Responsible Investment Scorecard is required to be considered a leader). The process reviewed investment managers on ESG stewardship, integration, transparency and avoidance of harm.

Led by our Sustainable Future team, Damian Cottier and Emilie O’Neill, we see the inclusion in this category as a great recognition of all the work that has been done so far. However, we do continue to improve our process and will continue to work with organisations such as Responsible Investment Association Australasia to help promote better outcomes for our investors.

Another section of the report we found interesting was the low usage of Positive Screening as a major approach to RI investing, ~0.2% as can be seen below. The key focus of the Sustainable Future Trust is to deliver strong financial returns while contributing to a better future by investing in companies that are having a positive impact – for instance in renewable energy, healthcare and education.

Source: the RIAA Responsible Investment Benchmark Report Australia 2020

If you would like to find out more about our Sustainable Future strategy, please click here.

For further information on the Responsible Investment Benchmark Report Australia 2020, please click here.

While the information contained in this article has been prepared with all reasonable care, Perennial accepts no responsibility or liability for any errors, omissions or misstatements however caused. This information is not personal advice. This advice has been prepared without taking account of your objectives, financial situation or needs.