The Australian energy market is massive. Annual NEM demand sits around 190 Terawatt hours (TWh) per annum, which means at currents prices it’s a ~$38bn market. That excludes multiple billions for growth and sustaining capex on top of that. It’s size, coupled with the immediate requirement for a low carbon augmentation, makes the power market fertile ground for investment ideas…

Plenty has been written on the intermittency of renewable power, and how that might be addressed. In orders-of-magnitude terms, batteries, while expensive, can play a part where the duration of storage required is measured in hours.

Seasonality is measured in months and is a much greater challenge. Most would be aware of the white-knuckled panic in Europe around August-September last year as the continent absorbed up as many LNG cargoes as it could lay its hands on to build gas inventories ahead of winter. Leaving a trail of less well-off countries gas-less in its wake. For example, Pakistan received a grand total of zero offers to it’s tender for 72 LNG shipments which concluded in October last year, and has since pivoted to coal.

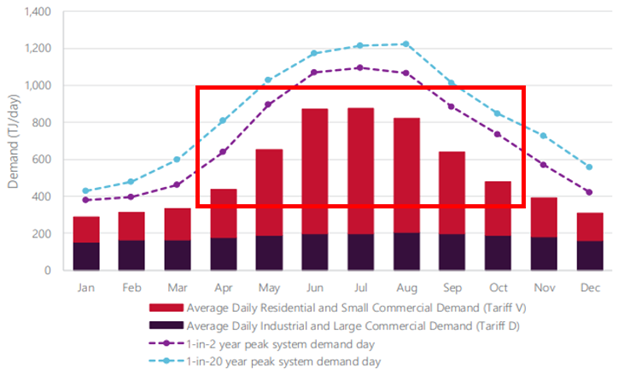

We have the same phenomenon, otherwise known as winter, in Australia. Which sees Victorian gas demand jumping by roughly 130% from March to June each year as the temperature drops:

Victoria Seasonal Gas Demand

Source: AEMO, Victoria Gas Planning Report Update, March 2020

Taking March as a baseline for Victoria gas demand, the cumulative seasonal gas requirement (red bars inside red box in chart above) to keep Victorian homes warm through winter sums to around 86 Petajoules of gas – which is a lot. That’s equivalent to 24 million megawatt hours in electricity terms, which at a current battery storage cost of A$1000/kilowatt hour works out to ~$24 trillion worth of battery storage. A stupidly large number. I haven’t made adjustments for efficiency of energy conversion for gas or batteries as I started down that route and quickly realised the outcome doesn’t change – batteries are not a solution for seasonal power storage and won’t be any time soon.

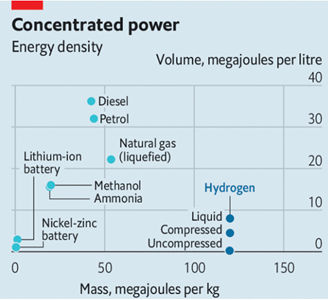

The key driver behind this ridiculous number is the low energy density of lithium batteries. Despite improving by roughly 10x over the last 15 years, it’s still an order of magnitude behind diesel or gas. That is, you need a lot more stuff to build a battery to store a given unit of energy vs gas or diesel, and that stuff (lithium, copper, graphite, aluminium etc.) is expensive, hence batteries are expensive.

Energy density is inversely correlated to materials intensity

Source: The Economist, DOE; Tran et al.; Vaclav Smil; SchrÖder et al.; Valera-Medina et al.

Hydro storage is much cheaper, using an estimate for final Snowy Hydro 2.0 capex, the figure is a comparatively modest $480 billion to cover Victorian seasonal demand. Still eye-watering but the bigger problem here is you’d need 68 Snow Hydro’s to store that much power, and Snowy Hydro 2.0 can’t be easily replicated.

With those few broad brush numbers for context, consider our power capacity mechanism, which is intended to be capable of supplying power on demand, won’t include coal or gas , Liddell coal power station which produces roughly 15% of NSW power closes down this year and the contractor building Snowy Hydro 2.0 recently went broke.

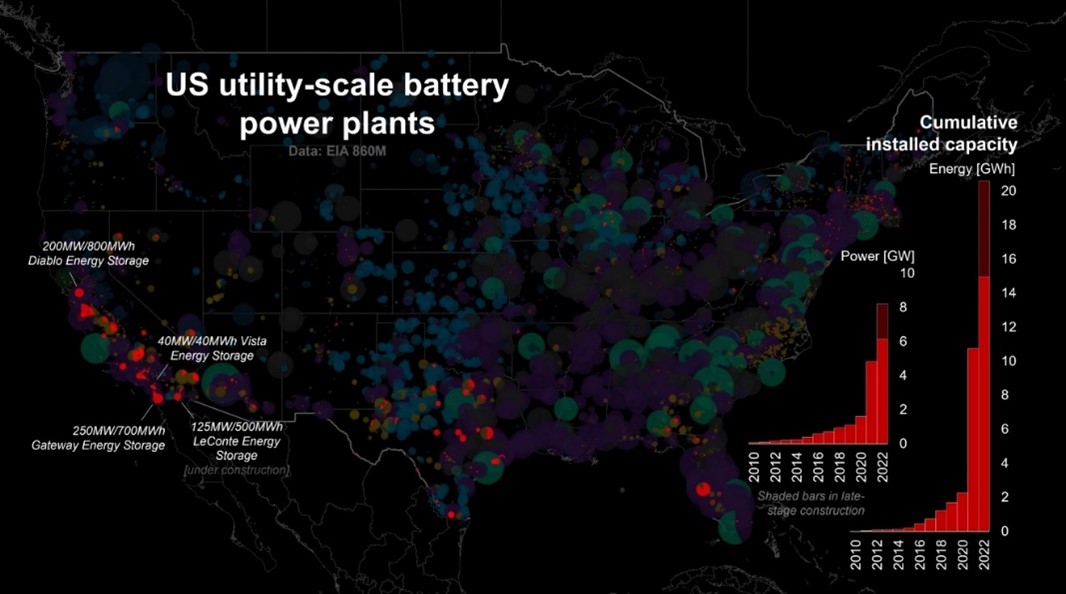

So while batteries can’t solve the seasonality problem on their own, but they’ll certainly cushion the blow for those that can afford them, which is why we’ve seen a surge in applications for battery connections currently sitting with AEMO which is sitting at around 44 GWhr or roughly A$44bn of investment should all those applications turn into real projects. For context that’s equivalent to Gorgon LNG, after the capex blowouts. Hence our bullish view on the rise of stationary energy storage as an investment thematic over 2023.

Stationary battery storage went exponential in 2022

Source: EIA

So how are we playing this thematic… firstly directly through investments in companies providing the storage solutions. At the utility end of the spectrum is GenusPlus (GNP), which is due to complete installation of a 200MWh battery for power utility, Synergy, in the March quarter this year. The project will contribute roughly 15% of GNP’s FY23 revenue and the pipeline of opportunities suggests battery installations could eclipse energy transmission as a core revenue driver for the business in the years ahead.

Serving large industrial clients is Synertec (SOP), which has developed a world first solar and battery system which delivers 24/7 power, 365 days a year. Synertec is working with Santos to replace diesel gensets across Santos’ gas operations in Queensland. We understand a broad spectrum of corporates, both domestic and international are watching the roll out of Synertec’s system closely.

Power prices and volatility have increased materially in recent years

|  |

At the residential level, we have supported Red Earth Energy as a private business, which we expect to list via IPO in 2023. Red Earth supplies small to mid-sized batteries to a spectrum of residential and mid-sized commercial customers. Red Earth has developed a wholesale power trading option for its customers which enables clients to take advantage of spikes in the wholesale power price, thereby reducing the payback period of its batteries.

Disclaimer: Please note that these are the views of the writer and not necessarily the views of Perennial. This article does not take into account your investment objectives, particular needs or financial situation. Some small changes were made to this article, based on updated information.