What is the EU Taxonomy?

The EU Taxonomy is a reporting requirement for investment funds selling to European consumers. It requires funds to clearly set out the percentage of assets aligned with environmentally sustainable activities under the EU Taxonomy framework.

The EU Taxonomy’s aim is to encourage private investment into sustainable projects that support the achievement of climate goals in the EU Green Deal. The European Commission’s proposal is that “the EU sustainable finance taxonomy will guide investment in Europe’s recovery.”

It is the first attempt at a standardised framework for what is considered “green” and will address some concerns of fund greenwashing. It will help investors compare funds and determine which are most aligned with climate change goals, as well as identify earnings growth opportunities for green aligned activities.

In order to qualify, an investment must be aligned with one of the six environmental objectives of the EU:

- Climate Change Mitigation;

- Climate Change Adaptation;

- Sustainable Use and Protection of Water and Marine Resources;

- Transition to a Circular Economy;

- Pollution Prevention and Control; and

- Protection and Restoration of Biodiversity and Ecosystems.

The investment must also meet a number of additional criteria including technical screening, “do no significant harm” and due diligence on minimum social safeguards.

The guidance for the EU Taxonomy has not been finalised, but full implementation is expected at the end of 2022.

What could the impact be?

We think that the taxonomy will accelerate investment into low carbon and environmentally friendly industries and companies. It encourages our long-standing view that low carbon technologies, carbon alternatives, energy efficient processes and environmentally friendly solutions are growth industries; while energy intensive sectors, coal mining and high emission businesses are facing structural challenges.

Corporates will be required to report the percentage of revenue, capital expenditure and operational expenditure aligned with the EU Taxonomy. This will encourage companies to invest in activities that will align with the Taxonomy as well as improve their environmental credentials and encourage in-depth environmental reporting. We also think the cost of capital would be lower for taxonomy aligned corporates.

As the reporting requirements roll out, we could also see an increase in demand for stocks that are likely to meet the EU Taxonomy criteria. Goldman Sachs estimates that around 41% MSCI ACWI have revenue >5% that is potentially taxonomy-eligible. These stocks would benefit from increased inflows, and potentially face a re-rate as capital is reallocated.

Additionally, it will increase the reporting requirements for sustainable oriented funds offering products to EU investors. If investors use the Taxonomy as a way to assess impact, it could redistribute flows into funds with a greater percentage of assets invested in environmentally sustainable industries.

The EU Taxonomy is predominately environmental focused given the goals are in alignment with the EU Green Deal. It raises the question as to whether a taxonomy focused on social or governance will be developed.

How does it impact Australian investors?

We think it is likely that the EU Taxonomy will have several implications for Australia.

Firstly, it could create an increased demand for Australian companies and assets in environmentally friendly assets and operations. Funds selling to Europeans that want to report alignment with the EU Taxonomy, may look to acquire or invest in companies in Australia that are Taxonomy aligned.

Additionally, the Australian market has seen an increase in the use of tools and frameworks to compare and assess the sustainability credentials of funds. An example of this includes the recent launch of the Lonsec Sustainability Rating. Other rating systems include the Ethical Advisors Co-op “green leaf” rating and the RIAA certification program. This is to help investors navigate fund “greenwashing”. It is possible that an Australian version of the EU Taxonomy could emerge as sustainable investing grows as an investment style. We have already seen some interest in a globally aligned taxonomy, and discussions of a taxonomy in Malaysia, Canada, China and Hong Kong. At the very least, it is likely to make investors more focused on the credentials of Australian funds that are marketed as sustainable.

How is Sustainable Future positioned?

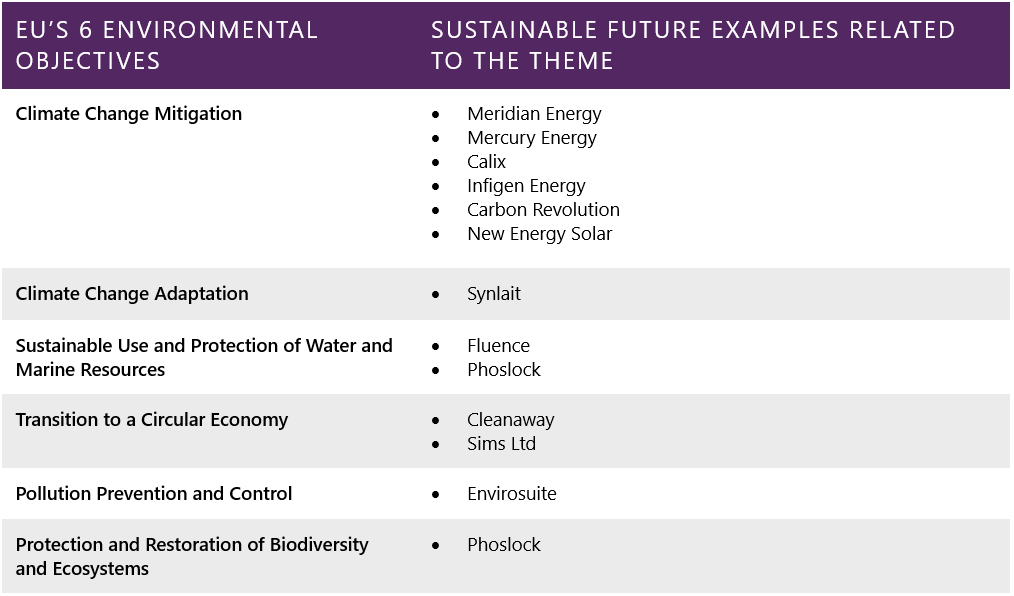

The Sustainable Future funds are well positioned to benefit from the EU Taxonomy. We think our environmentally focused holding companies could see an increase in demand as fund managers seek to align their portfolio with the EU Taxonomy and are well positioned for earnings growth. We have mapped our portfolio to the six environmental objectives of the EU Taxonomy in the table below.

Mapping the EU Taxonomy themes to the Sustainable Future Portfolio*

*Holdings as at June 30, 2020

The Sustainable Future Strategy would be in an advantageous position if an Australian version of an EU Taxonomy was to be introduced. Around ~25% of our portfolio is invested in companies whose operations are associated with improved environmental performance.

Acknowledgements:

Morgan Stanley Equity Research: EU Green Recovery: The stocks best-placed to benefit, EU Taxonomy: Climate Change Mitigation – Stock Ideas

United Nations Principles for Responsible Investment, https://www.unpri.org/

Goldman Sachs Research: Mapping Stocks to the EU Green Taxonomy, 15 June 2020

Disclaimer: Please note that these are the views of the writer and not necessarily the views of Perennial. This article does not take into account your investment objectives, particular needs or financial situation.