In the Perennial Better Future team, we are optimistic that ESG themes will remain a priority for companies and investors in 2022. While 2020 and 2021 were landmark years for ESG themes within the Australian listed market, we believe that the momentum behind ESG will be even greater moving into 2022.

We see momentum coming from several factions. While federal policymakers are taking small steps, albeit forward steps nonetheless, we expect that investor groups, corporates and general innovation will largely lead the way in addressing ESG issues in Australia.

Every year, the Perennial Better Future team publishes an ESG survey to gauge the “ESG pulse” of the 200 ASX-listed corporates that participate. The survey provides us with a unique insight into the key ESG areas of focus for these companies. Each year we find companies prioritise different factors and this year we would like to share with you the key ESG themes we see taking the spotlight in 2022.

Environment

Last year, we witnessed the UN Climate Change Conference in Glasgow – COP26 – bring the climate change crisis to the forefront of discussions between investors and corporates. More than ever, investors and shareholders are recognising the urgency of climate action required by companies to decarbonise our planet, prevent environmental decline, and shape a better future.

Investors are using their proxy voting responsibilities to vote for resolutions related to climate change and alignment with the Paris Agreement. For example, in September 2021 at AGL Energy’s (ASX: AGL) AGM, a resolution from a shareholder advocacy organisation calling for the company to adopt targets to reduce Scope 1, 2 and 3 emissions in line with the Paris Agreement, was supported by 52.56% of shareholders. While the resolution was not passed, since it was linked to a resolution to change in the company’s constitution which did not receive large support, it highlights investors’ and other stakeholders’ recognition of the pivotal role corporates play in alleviating the climate crisis.

Reducing greenhouse gas emissions and setting reduction targets

We anticipate that mounting pressure from investors to decarbonise will result in corporates’ increased focus on setting emissions reduction targets. With the number of net-zero and carbon-neutral targets set by ASX-listed corporates increasing, companies’ abilities to set realistic interim targets and Scope 3 targets is increasingly significant. Currently across the ASX300, 102 companies have set interim targets.

In evaluating the ESG performance of a company, investors assess the level of emissions related to the company and its operations, and the proactive measures the company has in place to reduce its emissions profile. This is important even for companies operating in relatively low carbon-intensive industries. Notably, greenhouse gas emissions were flagged as a key area of focus for ASX-listed corporates in our recent Perennial 2021 Better Future Survey. In 2022, we expect more companies to measure and disclose Scope 1 and 2 emissions and where possible, Scope 3 emissions. We are actively encouraging companies to set short, medium and long-term science-based targets to reduce their carbon footprint.

ESG Areas of Focus for ASX-listed Corporates in 2021

1: GHG Emissions including alignment with the Paris Agreement

1: GHG Emissions including alignment with the Paris Agreement

2: Worker rights, Modern Slaver and Human Rights Defenders

3: Cyber Security was a new response option in 2021

Source: Perennial Better Future Survey Report 2021

Green energy

As investors, we are noticing a significantly increased focus on green hydrogen as a potential energy source. We have also seen ongoing interest from offshore investors in acquiring Australian renewable energy assets. For example, in November 2021, a consortium of Shell and Infrastructure Capital Group (ICG) acquired Meridian Energy Australia’s energy retailer, Powershop. We anticipate increasing commitments by corporate Australia to move to renewable energy sources including solutions close to the source of energy use, such as solar and batteries.

In 2022, we expect to see investments by large energy players and institutional investors into green energy solutions including renewables, energy storage and hydrogen. Currently, green energy holdings within the Better Future strategies – the Perennial Better Future Trust and the eInvest Better Future Fund (ASX: IMPQ) – include Meridian Energy (ASX: MEZ) and Mercury NZ (ASX: MCY), which are both 100% renewable energy providers located in New Zealand. The New Zealand energy market is supported by almost 80% renewable energy. This compares to Australia’s energy market at around 25%. We believe Meridian Energy and Mercury NZ are well-placed for demand increases as countries and corporates commit to 100% renewable energy and alignment to the Paris Agreement.

We also anticipate an increase in the number of companies commercialising technologies that reduce carbon. For example, in November 2021, one of our Better Future investments, Calix (ASX: CXL), filed a patent for their “ZESTY” (Zero Emissions Steel TechnologY) technology which aims to decarbonise the iron ore process. Calix operates in the carbon technology space and is an industrial solutions company dedicated to solving global sustainability challenges. Calix has several interesting projects, including its “ZESTY” technology, which we believe will be met with increasing interest as companies look to decarbonise their operations.

Social and Governance

Multivariate diversity – Diversity to extend beyond gender

While gender diversity has been a significant focus for the market and Better Future, we expect increased discussion relating to broader diversity measures such as ethnicity, background, age, skills, disabilities and LGBTIQ+. Diversity is multidimensional, and an understanding of diversity metrics beyond gender enables a deeper understanding of a company’s workplace culture.

However, given that gender diversity is relatively easier to identify, with reporting of gender diversity metrics widespread across ASX-listed corporates, we have sought to target companies with less than 30% gender diversity on the board of directors. As a signatory to the 30% Club, Perennial supports the view that the board of directors of ASX-listed companies should have a minimum 30% representation of women. As such, the Better Future team recently wrote to all companies in the Better Future strategies with less than 30% females on the board.

In our view, a diverse board and management team leads to better outcomes for the business. We find that companies with greater female board representation benefit from the diversity of thought, background, and experience. This typically delivers better outcomes for the business, stakeholders, and shareholders over the medium term. We believe companies should have medium term board renewal plans for more balanced gender representation on the board. This topic was flagged as a key area of focus for ASX listed corporates in Perennial 2021 Better Future Survey.

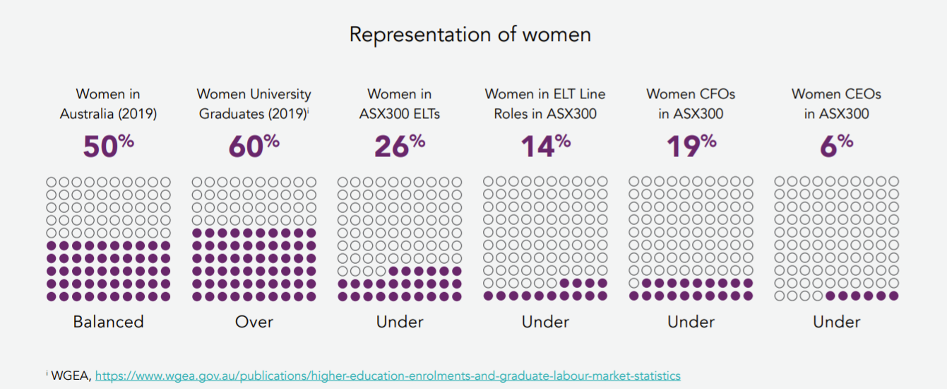

In 2022, we are also increasing our focus on gender representation in management “line” roles. In the Chief Executive Women (CEW) 2021 Census Report, CEW notes that “women hold only 14% of line roles (across the ASX300) with profit and loss responsibilities, revealing a narrow pipeline of women positioned to progress to CEO roles in the future”. Through increasing the representation of women in line roles, and setting gender targets for such positions, we believe companies can increase and accelerate the appointment of women in executive leadership teams (ELTs).

Source: Chief Executive Women (CEW) Census Report 2021

ESG-linked Remuneration

One way to hold management accountable to ESG-related objectives is to provide ESG-linked compensation. Linking ESG outcomes to remuneration structure will be a key focus for the Better Future team in 2022, as we believe companies’ alignment of management incentives with ESG performance can be significantly improved. Moreover, of the companies that do incorporate ESG performance metrics in management scorecards, most tie ESG compensation to Short Term Incentives (STIs), rather than Long Term Incentives (LTIs).

We would particularly like to see emissions reduction and alignment with the Paris Agreement integrated with executive remuneration structures to ensure that CEOs today are making progress toward typically distant, long-term net-zero and carbon-neutral goals.

Disclaimer: Please note that these are the views of the writer and not necessarily the views of Perennial. This article does not take into account your investment objectives, particular needs or financial situation.