The earlier excitement over IPOs has subsided… so where to next?

Flurry of IPO Activity Emerged from Mid Year as Market Conditions Improved

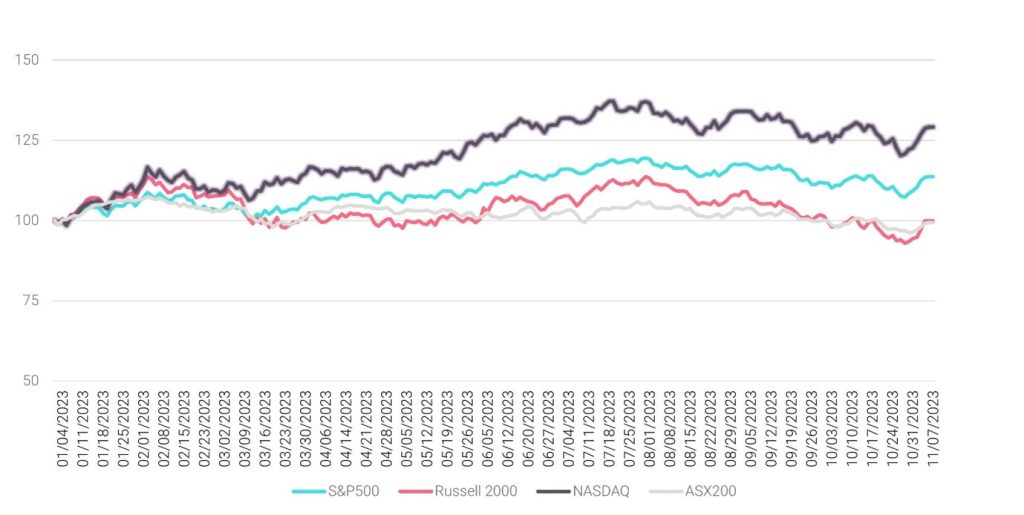

As volatility moderated in the middle of this year, a number of IPOs hit in the market raising hopes of a broader re-opening of the IPO window. Indices have also generally held up despite calls at the beginning of the year that markets would be significantly down The ASX200 which had traded up in the middle of the year has retraced its gains and is broadly flat to down. Similarly, the Russell 2000 which reflects the broader US market followed a similar trajectory.

YTD Performance: US Indices vs. ASX 200

Source: Factset; data to 7 November 2023

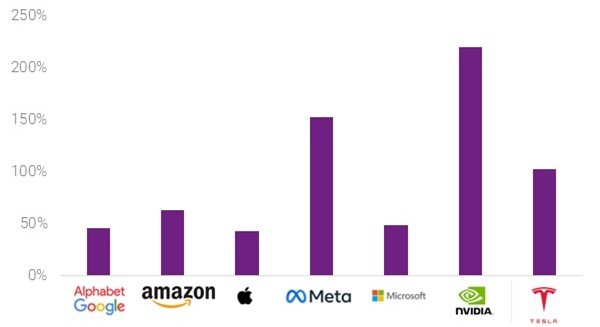

The S&P500 and NASDAQ have outperformed, owing much to the performance of the “Magnificent Seven” – Apple, Microsoft, Meta, Amazon, Alphabet, Nvidia and Tesla. This has been due to the excitement around artificial intelligence (AI) and dominance of big Tech and earnings exceeding analyst expectations. Combined, these companies have increased their market capitalization by more than US$4Tn for the year. These stocks also now make up 30% of the S&P 500 indicating a good degree of concentration of the indices and a major contribution to the S&P500 and NASDAQ Composite’s outperformance.

“Magnificent Seven” have Outperformed YTD

Source: Factset; data to 7 November 2023

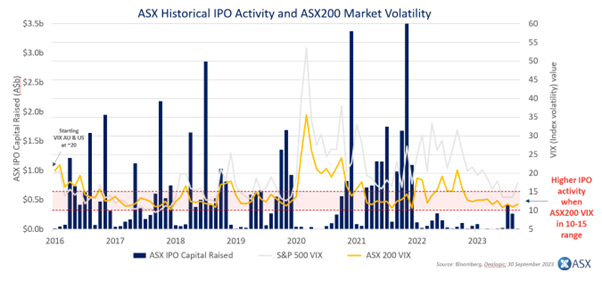

Historically, the IPO window never stays shut and as shown below, more IPO activity coincides with lower market volatility. So far, 2023 has seen average volatility, as measured by the VIX, well below 2022 levels which encouraged IPO hopefuls to make a play for a listing. But in the recent 4 to 6 weeks, we have seen an uptick in volatility with heightened geopolitical risks in the middle east and commentary indicating more hikes (even if near end of cycle) are possible as central banks seek to tame inflation. On the day where the “race that stops the nation”, it was the rates call that hopefully does not stop the nation as the RBA increased rates by 25bps to 4.35%, given inflation has not been curbed as quickly as in the US with price increases growing in the September quarter to 5.6%.

Lower Market Volatility Leads to More Capital Markets Activity, Including IPOs

Source: ASX, Bloomberg, Dealogic; data to 30 September 2023

Venture Capital and Private Equity Backed IPOs Return to the Market in the US

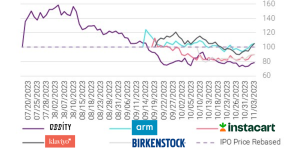

In the US, lesser-known ODDITY (beauty & wellness tech platform) tested the market in July with initial success. This was then followed by the much awaited IPO of chipmaker ARM in September. This was the first venture backed IPO since 2021 and Instacart (grocery delivery) and Klaviyo (marketing automation software) quickly followed suit. All of these IPOs had strong and solid first day and near-term aftermarket performance. By the time L Catterton backed Birkenstock (footwear) listed in early October, the excitement around the IPOs had abated.

ODDITY, Instacart and Klaviyo revised their IPO pricing ranges upwards and ended up pricing at the top of, or above the range. ARM also priced at the top end of its initial filing range while Birkenstock, one of the worst performing large IPOs in recent history (breaking issue on the first day of trading) priced in the middle of the range. Birkenstock was impacted by a hefty valuation as well as LVMH announcing softening sentiment in European consumers as part of its 3Q results.

The VC-backed tech IPOs in particular, are a crucial valuation marker given the IPOs were priced at both a discount to peers and deep discount to the last private round. This also provides a valuable marker for later stage private investors on where to price their deals given the likely appetite at IPO. While profitability is important, investors are also focused on where the next leg of growth can come from. For example, with ARM, the focus was on its exposure to AI and Klaviyo on its expansion into adjacencies. Currently, both ARM and Klaviyo are both trading back in the black after the mentioned IPOs have broken issue.

Selected US IPO YTD Performance

Source: Factset; data to 7 November 2023

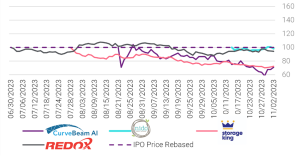

ASX: Industrial and Profitable IPOs are First Off the Block

Outside of Curvebeam AI (medical imaging and clinical assessment) which is an unprofitable business, the more recent non-resources IPOs to test the Australian IPO market include Redox (chemical distributor), Abacus Storage King (demerger IPO) and Nido (childcare centres) which have demonstrated steady growth and profitable profiles. Similar to the US, performance has been lacklustre to date with all four breaking issue price. Unlike the US where the recent technology IPOs had tight free floats of 5% to 10%, the ASX requires 20% a free float so the Australian IPOs have had the benefit of more initial liquidity.

Selected Australian IPO YTD Performance

Source: Factset, Data to 7 November 2023

Given current market volatility, IPO hopeful Cuscal (payments) which was due to IPO by end of November, ultimately pulled the pin on a 2023 IPO, citing ‘external environment’ factors. Cuscal had earlier switched from a front end to short 2 day back end bookbuild which indicated that macro risks were top of mind for investors. Clearly, the macro risk factors which could escalate quickly did not make it an ideal time to come to market.

IPO Outlook into 2024

The pipeline continues to build both in the US and Australia. In Australia, two sizeable IPOs (>$A$1bn) which would have brought back the much needed volumes in 2023 , have now been postponed into the new year – Molycop (mining services) and Virgin (airline). Other hopefuls such as Mondiale VGL (international freight forwarder) and Mason Stevens (wealth platform) have also postponed their IPOs to 2024 and now we can add Cuscal to the list. Other IPOs in the pipeline include: Airtrunk (data centres), Tasmea (engineering services) and Guzman Y Gomez (Mexican fast-food chain).

The macro backdrop will be closely watched by IPO hopefuls, including the interest rate trajectory and potential escalation of geopolitical tensions.. US 3Q 2023 earnings have also generally surprised on the upside so it is the first year on year growth in earnings since 3Q 2022. However, commentary is cautious into 4Q and for 2024. Despite potential headwinds, companies are not necessarily shying away from IPOs as they do not want to be caught out when the window fully re-opens.

The type of initial IPOs that will likely get away would be ones with demonstrated growth coupled with profitability which would then pave the way for much awaited ‘growth’ / technology IPOs. Furthermore, as we have seen in the US, valuation will be key as the IPO is the beginning of the listed journey and attractive pricing will likely be needed to muster more interest across the investor universe. Currently, IPO candidates are looking at dual track processes, getting internally prepared (prepping the equity story and getting financials & audited accounts in order) as well as working with advisors on non-deal roadshow meetings to think about how to best position their investor register.

Being IPO ready also preserves optionality for companies looking for exit or liquidity options and may be the best option where there is not sufficient depth in the private markets. Companies would need to be ready as the IPO window can close just as quickly as it opens as we have seen in 2023.

Disclaimer: Please note that these are the views of the writer and not necessarily the views of Perennial. This article does not take into account your investment objectives, particular needs or financial situation. Some small changes were made to this article, based on updated information.