After S&P Dow Jones announced the Australian equity mid and small cap sector was the most consistent sector over three years, Money Management took a deep dive into individual fund performance.

In its research, the ratings provider found 29.4% of funds in this sector which outperformed their benchmark in 2017, consistently outperformed in the subsequent two years to 31 December, 2019. This compared to 15.8% of funds across all Australian equity categories.

The benchmark used by the ratings agency was S&P/ASX Mid Small Cap index. Looking at latest data, this index returned 18.9% between 01 June, 2017 to 31 May, 2018, 2.7% between 01 June, 2018 to 31 May, 2019 and lost 1.9% between 01 June, 2019 to 31 May, 2020.

According to FE Analytics, there were 51 funds, within the Australian Core Strategies (ACS) universe, in the Australian equity small/mid cap sector which beat that index in 2017/18. Some 22 funds of these then beat the index in 2018/19 and a further 16 beat it in 2019/20 as well.

This means, out of the 85 funds which had been launched in June 2017, some 16 had consistently beaten the benchmark since then, representing 18% of funds in the ACS sector.

These funds were 8IP Australian Small Companies, Alpha Australian Small Companies, Ausbil MicroCap, CFS Colonial First State Wholesale Australian Small Companies, CFS FirstChoice Wholesale Australian Small Companies, Eley Griffiths Emerging Companies, Fairview Equity Partners Emerging Companies, Fidelity Future Leaders, Flinders Emerging Companies, Macquarie Australian Emerging Companies, OC Micro-Cap, Ophir Opportunities, Pendal MicroCap Opportunities, Perennial Value Microcap Opportunities Trust, UBS Australian Small Companies and UBS Microcap.

Between June 2017/18, the best performer was Perennial Value Microcap Opportunities Trust which returned 61.7% versus index returns of 18.9%. Between June 2018/19, SGH Emerging Companies returned 15.6% versus index returns of 2.7% (although this fund did not outperform the following year). Lastly, between June 2019/20, Ophir Opportunities returned 15.5% compared to losses by the index of 1.9%.

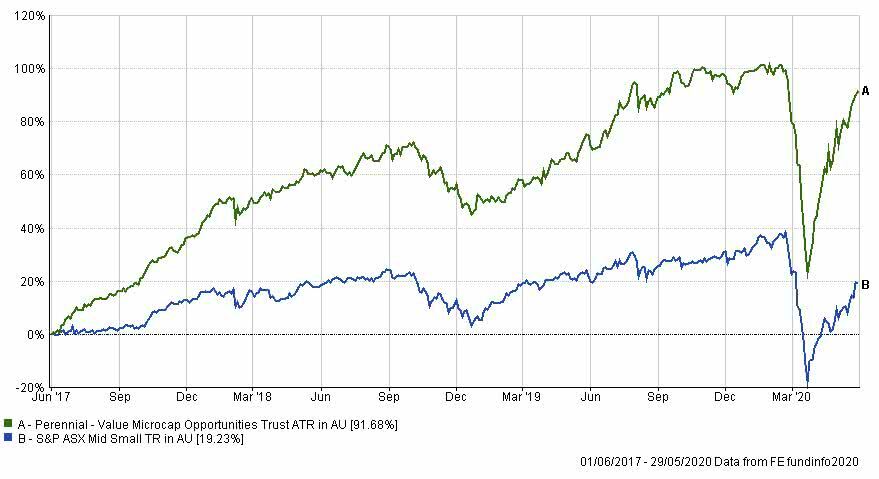

The best-performing fund over all three years to 31 May, 2020 was Perennial Value Microcap Opportunities Trust which returned 91% versus returns of 19.2% by the S&P/ASX Mid Small index. The wider Australian equity small/mid cap sector had returned 23% over the three-year period.

Performance of Perennial Value Microcap Opportunities Trust versus S&P ASX Mid Small index over three years to 31 May 2020.

Read original article from Money Mangement

Disclaimer: Please note that these are the views of the writer and not necessarily the views of Perennial. This article does not take into account your investment objectives, particular needs or financial situation.