Why it was time to part with a smile

As part of being of being an investment manager, many investors like to hear about our top tips. However I believe that it is the sell discipline that is an even more important aspect of being a great investment manager. Below is an example of how Perennial’s sell discipline has been applied recently with Smiles. We continue to watch the company but we aren’t putting our clients money to work at the moment.

Without a doubt, the Australian dental industry is following in the footsteps of that of the United States with the increasing prevalence of corporatisation. You may be wondering – what is this trend? Corporatisation of dental practices is, in short, major corporate entities owning individual dental practices. In Australia, the dental industry remains a highly fragmented cottage industry. There are many local, small practices available for large corporates to potentially acquire and integrate into their own network. These days it is becoming a common feature to see more and more clinics owned and/or managed within a corporate group to share branding. This is seen with ASX listed players such as Pacific Smiles (ASX:PSQ), 1300Smiles (ASX:ONT) and the ‘Totally Smiles’ brand of Smiles Inclusive (ASX:SIL).

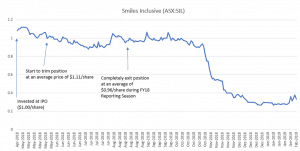

In early 2018, we entered this sector by participating in the IPO of Smiles. The business model of corporatised dentistry has had a reputation of being very lucrative, particularly in the United States, with a report published by the American Dental Association highlighting the prevalence of larger revenue growth under the corporate model in comparison to the performance of individual smaller practices (Source: “Very Large Dental Practices Seeing Significant Growth in Market Share).

However, as we continued to research SIL after its listing, we lost conviction and eventually exited our position at a small loss. As the analyst responsible, I had two major concerns and these led to our ultimate exit of the stock:

1) Ambitious targets and distracted management

Around the time of our investment at IPO, we felt comfortable that management could successfully acquire the 52 dental practices it had contracted to buy. We initially liked SIL’s business model, with its JV arrangement with vendor dentists fostering long-term performance incentives. It also offered dentists the opportunity to focus on their love of dentistry and handover the cumbersome administrative processes of running a practice to SIL, which seemed like a win-win for both dentists and the business.

However post the listing, we started to see the company begin to heavily brand itself as a dental marketing company to investors. We began to feel SIL management may have been too occupied with this as opposed to ensuring the integration and operational roll-up of dental practices was on track. It appeared that management were trying to do too much in such a short space of time. We began to have concerns regarding the stability of the business and the likelihood SIL would perform as much as management and various market participants had hoped.

2) Discretionary spend

Shortly after our initial investment, a weaker consumer environment and a weak Australian housing market remained evident. The company tried to offset this macro environment by attracting patients, particularly millennials, by making dental services relatively more affordable. They did this by partnering with Zip Money and Afterpay. However, dental attendance remains weak and it appears that many are under appreciating the discretionary nature of dentistry. We believe that attendance is expected to remain weak in the near term as the average consumer continues to face lacklustre economic conditions.

Our view on SIL was eventually reflected in announcements made to the market after our decision to exit the stock. Announcements have revealed SILs missing of financial performance measures, failing to meet budgeted amounts, and reports of integration issues in the purchase of dental practices.

While SIL has disappointed, we remain abreast of its developments and monitor for a potential turnaround. We retain exposure to the healthcare sector via Integral Diagnostics, which is less discretionary, and via investments in the biotechnology space which exhibit a better risk/return profile.

These are the views of the author, Marni Lysaght, Equity Analyst, Perennial Value.

The output of Marni’s research and analysis can be found in the Perennial Value Smaller Companies Trust, Perennial Value Microcap Opportunities Trust and Perennial Value Sustainable Future Trust. Reliance should not be placed on this article as the basis for making an investment, financial or other decision. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.